Nottingham Building Society Launches Mortgage Solution for Foreign Nationals

The Nottingham Building Society has launched a mortgage solution designed to support the growing number of foreign nationals who work in the UK and are looking to own a home. This product addresses a growing demand from mortgage brokers who said existing products were too restrictive when supporting skilled workers from abroad who are looking to borrow money to buy a home.

Foreign nationals can now access mortgages with ease

Foreign nationals can now access mortgages with ease

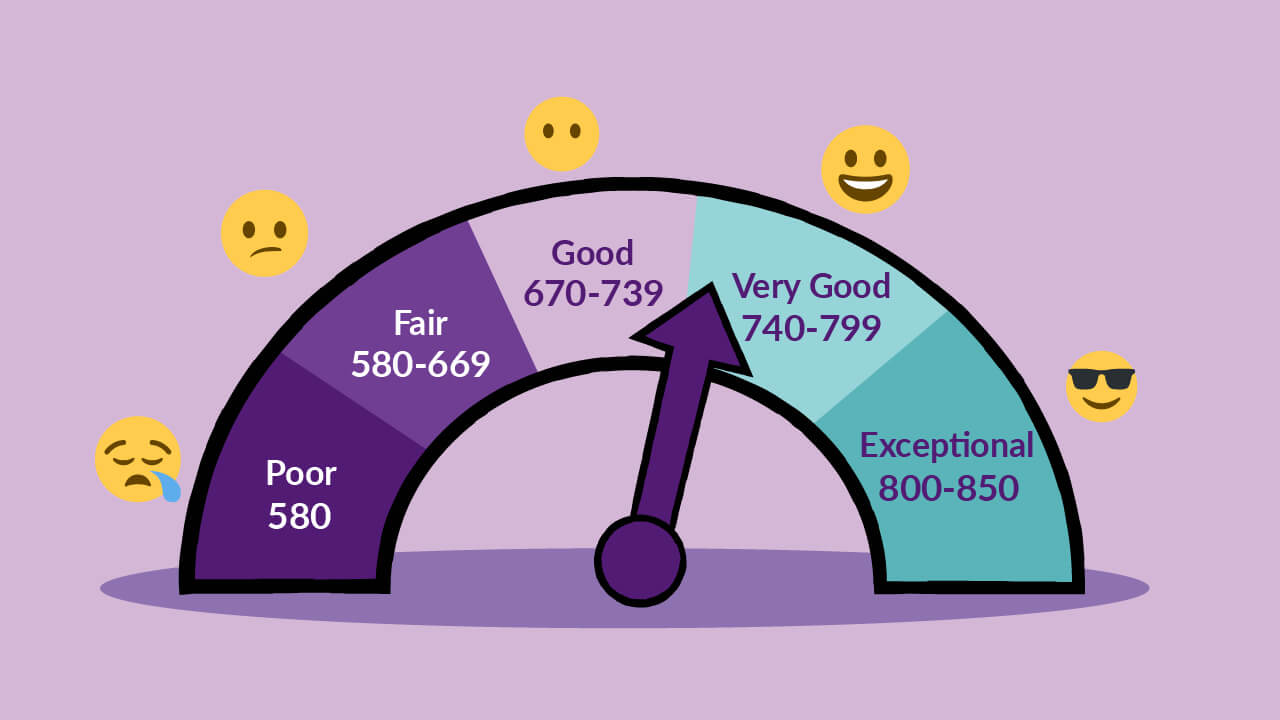

Most notably, the product does not require borrowers to have spent any minimum length of time in the UK before applying. In addition, a lack of credit history is one of the main reasons why foreign nationals, particularly those who have been in the UK for less than a year, struggle to get a UK mortgage.

Credit history is no longer a barrier for foreign nationals

Credit history is no longer a barrier for foreign nationals

Nottingham Building Society has partnered with cross-border credit bureau Nova Credit. This will allow mortgage brokers to access historic credit files in a growing number of countries worldwide, including India, Philippines, Australia, US, Canada, Germany, Austria, Spain, Switzerland, Mexico, Dominican Republic, Kenya, and Korea.

Access to global credit files made easy

Access to global credit files made easy

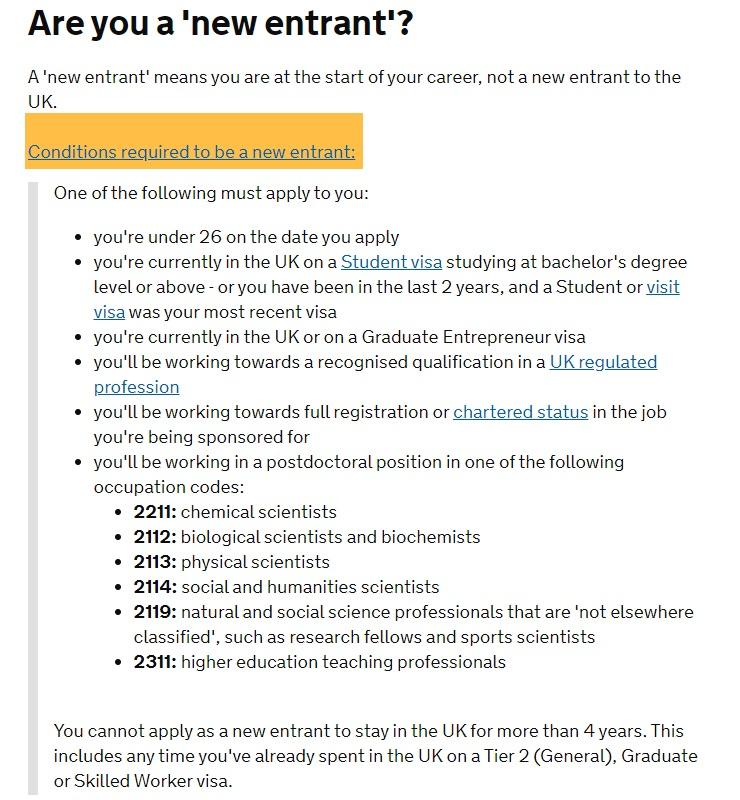

The product is available up to 95% loan-to-value (LTV), but capped at 75% LTV if no credit score can be provided. It requires no minimum income, and no minimum time remaining on a UK visa. The product will primarily be available to borrowers entering the UK on a Skilled Worker or Health and Social Care Worker visa.

Skilled workers can now access mortgages with ease

Skilled workers can now access mortgages with ease

Alison Pallett, sales director at Nottingham Building Society, said: “This is a fantastic solution, one we know brokers have been crying out for.”

Alison Pallett, sales director at Nottingham Building Society

Alison Pallett, sales director at Nottingham Building Society

“We hope it will empower more borrowers from overseas to realise their home-buying dream in the UK, particularly those new to the UK who struggle to demonstrate their credit history.”

Foreign nationals can now achieve their home-buying dreams

Foreign nationals can now achieve their home-buying dreams

Praven Subbramoney, chief lending officer at Nottingham Building Society, added: “It’s a proud moment for us to be able to introduce this exciting new product; one that will transform the homeownership prospects for the growing number of foreign nationals coming to live and work in the UK.”

Praven Subbramoney, chief lending officer at Nottingham Building Society

Praven Subbramoney, chief lending officer at Nottingham Building Society

“Many thousands of people come to the UK to work and indeed, we rely on skilled foreign workers in critical areas like healthcare and technology.”

Skilled foreign workers are crucial to the UK’s healthcare sector

Skilled foreign workers are crucial to the UK’s healthcare sector

“But up until now many have been unable to obtain a mortgage within the first two years of being in the country because of restrictive and inflexible lending criteria.”

Restrictive lending criteria are a thing of the past

Restrictive lending criteria are a thing of the past

“We want to change that.”

A new era for foreign nationals in the UK

A new era for foreign nationals in the UK

Subbramoney added: “As a foreign national, trying to get a mortgage proved far more complicated and frustrating than it should have been.”

The frustration of trying to get a mortgage as a foreign national

The frustration of trying to get a mortgage as a foreign national

“It’s as if only 75% of me was allowed into the country - the UK was able to match my aspirations to earn a good living and play my part in supporting the economy, but I was unable to comfortably settle with my family.”

Settling in the UK with family is now a reality

Settling in the UK with family is now a reality

“The need to better support under-served segments of the market is central to our purpose as a forward-looking building society.”

A forward-looking building society

A forward-looking building society

“And we are delighted to be able to now meet the evolving demands of people moving into the country, not just as a place to earn money but to settle long-term, put down family roots and make the UK their home. That’s the role we believe a modern mutual should fulfil.”

A home in the UK is now within reach

A home in the UK is now within reach

Misha Esipov, CEO and co-founder at Nova Credit, said: “When people move countries, we believe they should be able to bring their credit history with them.”

Misha Esipov, CEO and co-founder at Nova Credit

Misha Esipov, CEO and co-founder at Nova Credit

“We are delighted to partner with Nottingham Building Society to enable UK newcomers who have the means and credit track record to put their best financial foot forward to access mortgage financing.”

Mortgage financing made easy

Mortgage financing made easy

“With our Credit Passport solution, Nottingham Building Society can take advantage of a compelling new expansion and tap into a valuable, under-served market that has been hiding in plain sight.”

Credit Passport solution

Danny Belton, head of lending at Mortgage Advice Bureau, concluded: “There are a growing number of foreign nationals looking to come to the UK, bringing critical skills and years of experience to the workplace. However, obtaining a property to live in has been a significant challenge for many.”

Danny Belton, head of lending at Mortgage Advice Bureau

Danny Belton, head of lending at Mortgage Advice Bureau

“It’s great to see that Nottingham Building Society has taken a pragmatic approach to the problem by providing a leading solution that can help these customers.”

A solution for foreign nationals

A solution for foreign nationals