Paying Off Your Mortgage Early: A Savvy Saver’s Story

Most of us think that paying off our mortgages is a distant dream, but one savvy saver has found an easy way to get out of debt early and save £10,000 in the process.

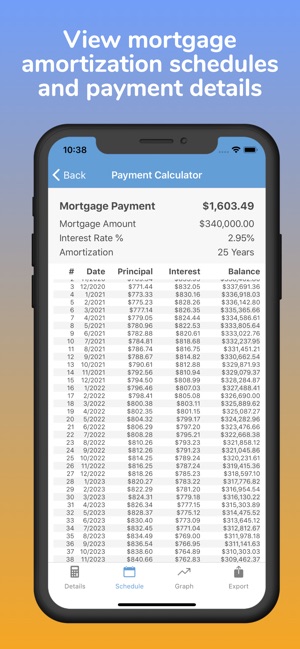

Mark Rice, a 59-year-old from Nottingham, has been making use of an app that helps him to overpay the loan he owes to Nationwide on his home. Since downloading the app last year, he has already paid off over £2,000.

Using an app to simplify mortgage overpayments

Using an app to simplify mortgage overpayments

Mark now has ten and a half years left on his mortgage and £61,000 left to pay. If he keeps up with the overpayments, he will have the whole lot paid off around three years early, meaning he will be mortgage-free and saving himself in the region of £10,000 in interest payments.

“I was looking for a way of simplifying mortgage overpayments, so that I can pay down my mortgage as quickly as possible,” says Mark.

The app helps people with saving to pay off their homes in several ways. Firstly, it is a more simple way of saving and paying than doing it directly with your bank. It also acts like a financial adviser, Mark said.

“It isn’t that straightforward to overpay your mortgage directly with your bank – I suppose in terms of a business model, it’s not in their best interest for you to be paying off your mortgage quicker,” Mark added.

The app encourages users to set aside cash on a regular basis into a repository, which can then be released directly to the mortgage lender when a pot of over £500 has been accumulated.

Mortgage overpayment can save you thousands

Mortgage overpayment can save you thousands

Mark, a project manager for an NHS Trust, also makes easy extra cash to put towards the mortgage payments – by taking part in daily market research surveys through the app. He added: “You can generate additional payments with very little effort. On a daily basis, I complete surveys on my phone while I’m commuting to and from work, or during my lunch break.”

The app also offers cashback offers on everyday purchases, such as coffee from Costa Coffee and Cafe Nero, as well as supermarkets like Asda, Tesco, and Morrisons, and even on takeaways from Deliveroo or UberEats.

Before you think about making extra payments, check with your lender first. Some lenders might not let you make overpayments at all, so make sure you get all the information you need about whether you can set up a regular or one-off payment.

You should also be aware that you might be slapped with a fee if you overpay too much on your mortgage. This is usually between 1% and 5% of the amount overpaid.

Lenders also don’t make it easy to do, but there are tricks which help you. For example, if you make an overpayment, their default response is to reduce your next monthly payment rather than reducing the term, so you have to go online, check your settings, and change them.

Mortgage savings can add up quickly

Mortgage savings can add up quickly

Should You Overpay Your Mortgage?

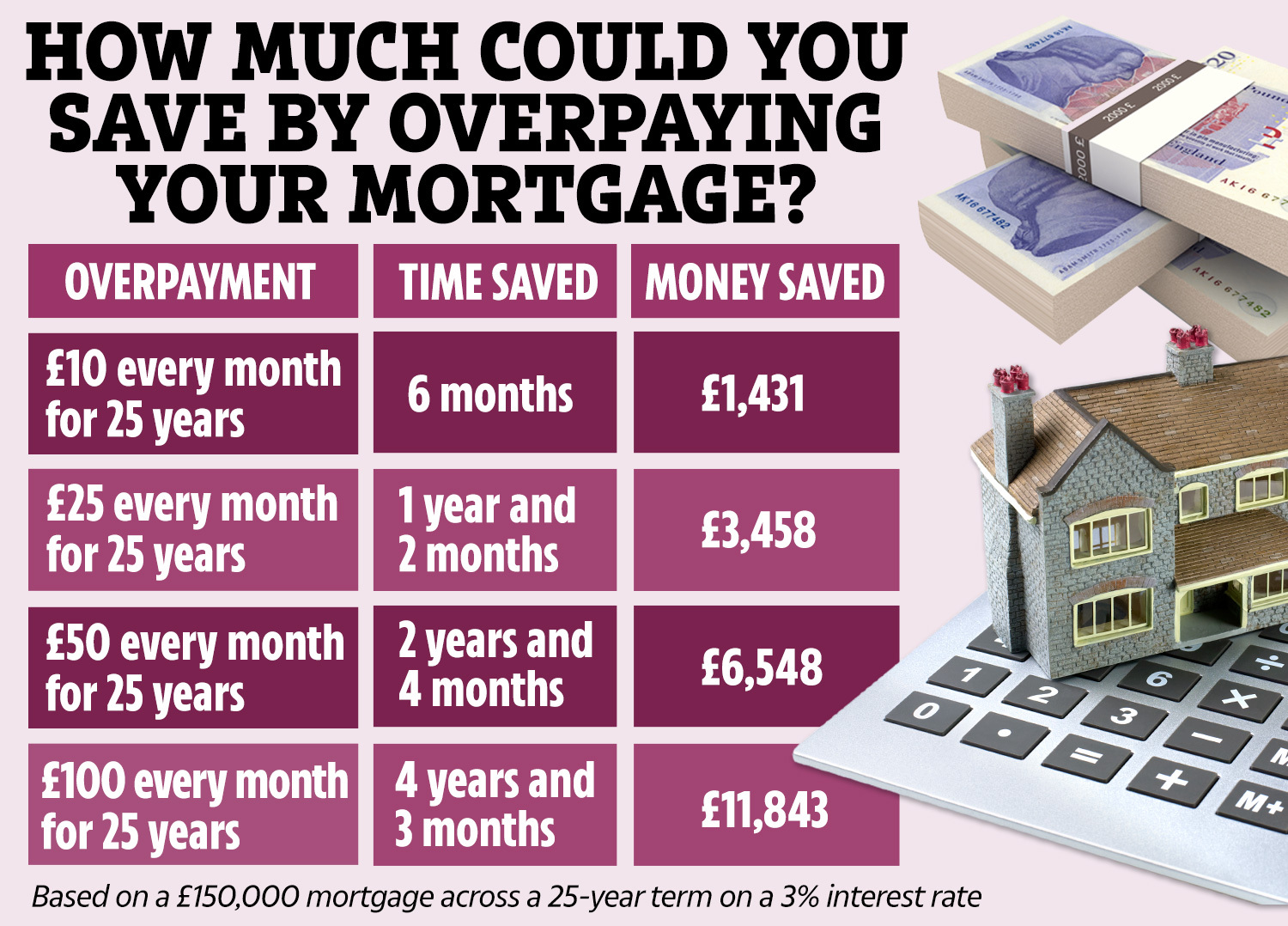

You might not have the spare cash to do this – but if you do, it could help you make a big saving. On a £100,000 mortgage over a 25-year term, paying an extra £90 a month would save over £4,800 of interest and see the loan repaid nearly three years early, according to calculations by Halifax.

And even smaller overpayments can still have a big impact. For example, paying an extra £25 each month on a £250,000 mortgage fixed at a rate of 5% would save £23,986 over a 40-year term, according to Sprive.

However, it’s important that you don’t overpay too much as lenders often cap the amount at 10% per year – or you’ll face a hefty charge.

If you do it yourself, your lender will give you two options. Either reducing your next payment or reducing your mortgage term. You want to pick the second option as this will help reduce the debt and interest you will pay in total.