Planning Your Farewell: A Look into Prepaid Funeral Plans and Their Importance

Death is a topic many prefer to sweep under the rug, but as I delve into the subject of planning for the inevitable, I recognize that approaching this matter with the right frame of mind can not only ease our own worries but also protect our loved ones from unnecessary stress down the line.

The Current Landscape of Funeral Planning

Many of us are aware that amid life’s uncertainties, death remains a certainty. Yet, according to a recent survey conducted amongst Which? members, a staggering 24% of respondents haven’t even begun to consider their funeral plans. Another 29% have thought about it but have kept their plans under wraps, leaving their families in the dark.

Interestingly, while 46% have broached the subject with loved ones, the conversation often focuses more on what they do not want rather than the preferences they hold dear. Given the spiralling costs associated with funerals today, it’s imperative that we direct our focus on how to plan ahead to spare our families the burden during an already challenging time.

Exploring the intricacies of funeral planning.

Exploring the intricacies of funeral planning.

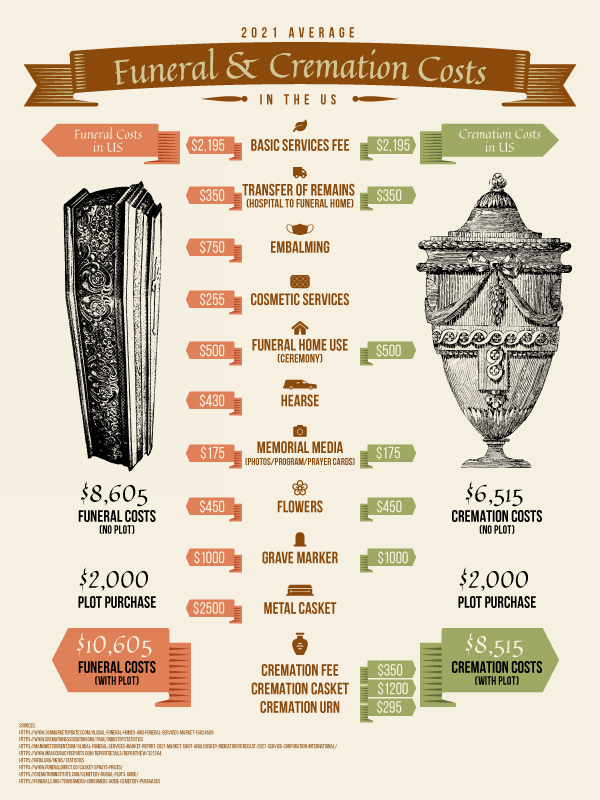

Understanding the Costs

Post-pandemic, funeral prices saw a dip, but they are back on the rise. The average cost of a basic funeral in 2023 has climbed to £4,144, with expectations it could soar to £5,126 by 2028. This figure covers the essentials: a coffin, burial or cremation, and service fees. However, when we factor in additional expenses such as wakes or estate management, the total skyrockets to an alarming £9,658, a historic high. It’s evident that many families are feeling the monetary strain, leading to decisions like trimming back on floral tributes or even opting for a simpler funeral service.

For further insights into funeral costs, you can read about funeral costs explained.

The Rise of Direct Funerals

Given the financial strain many families are experiencing, the uptake of direct funerals is becoming increasingly popular. This option, which bypasses elaborate ceremonies, costs around £1,498—nearly 60% less than a conventional cremation. This is a telling reflection of current economic realities. One particular member reflected candidly:

“I do not wish to burden my spouse and children with further emotional and financial costs. Spend money on a drink and meal to remember me.”

Documenting Your Wishes

Planning a memorable farewell is about more than just finances; it’s about ensuring your wishes are honored. A particular sentiment stood out among responses: many wish to have their ashes spread in meaningful places or to be buried alongside loved ones, including one quirky request to be laid to rest near feline friends.

To ensure there’s no ambiguity regarding your desires, it’s worthwhile to document your wishes formally. Creating a Letter of Wishes that accompanies your will can clarify your intents, alleviating potential disputes among family members after you’ve passed.

Ensuring your wishes are clearly laid out.

Ensuring your wishes are clearly laid out.

Evaluating Prepaid Funeral Plans

As our financial means can significantly influence our funeral options, many individuals plan to leave funds behind. However, alarming statistics reveal only 43% manage to save enough for their funeral expenses, leaving an average shortfall of £1,872. This is where prepaid funeral plans come into the conversation. By locking in today’s prices and ensuring these funds are exempt from inheritance tax, they work to prevent financial hardship after loss.

Despite their advantages, it’s tough to overlook that prepaid plans have faced their fair share of criticism over the years for issues like aggressive sales tactics and questionable value—leading to regulatory changes that aim to protect consumers. You can read more about these plans by visiting prepaid funeral plans explained.

Alternative Financial Solutions

Interestingly, the survey revealed that three-quarters of members intend to cover funeral expenses through their estate. Although procedures often mean accounts are initially frozen after someone’s passing, banks typically release funds upon receiving an itemized bill and death certificate. For families needing immediate support, this can lead to upfront costs that might need reimbursement after probate, which averages about nine weeks.

For those exploring eventualities further, consider tools like life insurance as part of the financial planning mix.

Financial planning is key to easing your family’s burdens.

Financial planning is key to easing your family’s burdens.

A Thoughtful Conclusion

Ultimately, contemplating our own funerals can be an unsettling experience, but it’s essential. Planning ahead not only alleviates anxiety but also ensures our final send-off mirrors our desires while alleviating the financial burden on those we love. As I reflect on the importance of taking these proactive steps, I can’t help but feel that it’s both a responsible and thoughtful legacy to leave behind, encouraging each of us to embrace the topic of death with the seriousness it deserves, and perhaps even a hint of levity.