High Mortgage Rates: A Barrier to Home Ownership

As a homeowner, I’ve always been fascinated by the intricacies of the housing market. Recently, I’ve been following the trends closely, and one thing has become abundantly clear: high mortgage rates are pricing out buyers.

According to Nationwide, while earnings have been rising faster than house prices in recent years, this hasn’t been enough to offset the impact of more expensive mortgages. The building society’s chief economist, Robert Gardner, notes that mortgage rates are still well above the record lows prevailing in 2021. For example, the interest rate on a five-year fixed-rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021, but in recent months, this has been nearer to 4.7%.

Mortgage rates have been on the rise

Mortgage rates have been on the rise

As a result, housing affordability is still stretched. The impact of higher borrowing costs can be seen in the fact that transactions involving a mortgage are down by nearly 25% over the past year. Meanwhile, the number of cash transactions for properties is about 5% higher than pre-pandemic levels.

Across the UK, Northern Ireland saw the biggest price increases, up 4.1% from a year earlier. Wales and Scotland both saw a 1.4% annual rise. Prices in England climbed by 0.6%, with northern regions seeing bigger increases in general than the south.

The Focus is on the Bank of England

The focus is now on the Bank of England’s Monetary Policy Committee (MPC), which sets interest rates, to see if it decides to cut at its next meeting on 1 August. According to financial information service Moneyfacts, the average rate on a two-year fixed mortgage deal stands at 5.95%, while for a five-year deal the average is 5.53%.

The Bank of England’s Monetary Policy Committee sets interest rates

The Bank of England’s Monetary Policy Committee sets interest rates

“Buyers may find their mojo again when we get a rate cut from the Bank of England,” said Sarah Coles, head of personal finance at Hargreaves Lansdown. “This could come as early as August, although sticky services inflation and higher wages could mean we need to wait until the autumn.”

Ways to Make Your Mortgage More Affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable, although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

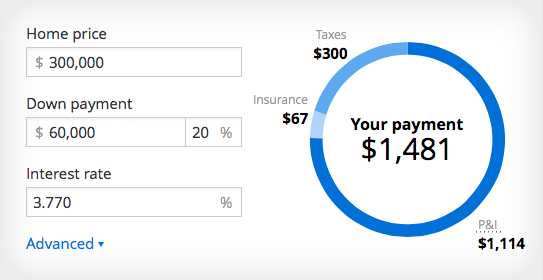

Mortgage calculators can help you plan your finances

Mortgage calculators can help you plan your finances

The Road Ahead

As we look to the future, it’s clear that high mortgage rates will continue to affect the housing market. However, with the Bank of England’s next meeting on the horizon, there’s hope that rates may drop, making it easier for buyers to get on the property ladder.

The dream of home ownership is still within reach

The dream of home ownership is still within reach

Photo by

Photo by