Remortgage Payments on the Rise

According to the latest data from LMS, a staggering 71% of borrowers who remortgaged in April saw their payments increase compared to their previous mortgage deals. This trend is a stark contrast to the 22% who enjoyed a decrease in their monthly bills.

Mortgage payments on the rise

Mortgage payments on the rise

The average monthly increase for those who saw their payments rise was a substantial £355. This significant jump in payments has left many borrowers reeling.

Remortgage Instructions Down, Completions Up

Despite the increase in payments, the number of remortgage instructions decreased by 4% in April compared to March. However, completions were up by 9% during the same period. This trend is expected to continue, with LMS chief executive Nick Chadbourne predicting another spike in remortgage instructions towards the end of July.

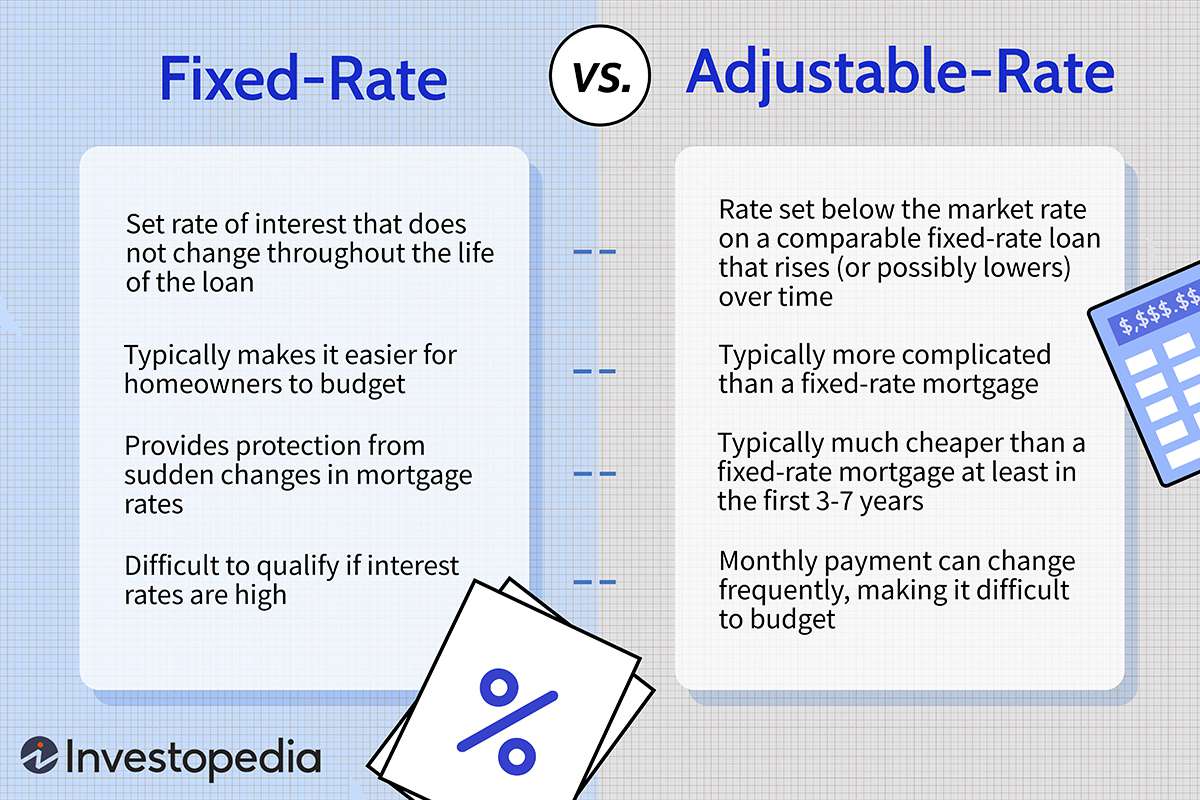

Fixed-Rate Mortgages in High Demand

The most popular mortgage product among borrowers was the five-year fixed-rate mortgage, with 44% opting for this type of deal. This was closely followed by two-year fixed-rate mortgages, which accounted for 43% of the market.

Fixed-rate mortgages in high demand

Fixed-rate mortgages in high demand

Borrowers Seeking Certainty

According to LMS, 73% of borrowers are motivated by security and wanting to know exactly how much they need to pay each month. This desire for certainty is driving the demand for fixed-rate mortgages, as borrowers seek to shield themselves from potential interest rate fluctuations.

“The key mortgage figures from UK Finance in 2023 showed an increase in product transfers of 17.1% compared to those in 2022 – it is clear that the PT trend has continued into 2024,” said Nick Chadbourne. “While not as significant as April, we are heading towards another spike [in current deals ending] at the end of July.”

The shift towards fixed-rate mortgages is a clear indication that borrowers are prioritizing certainty and stability in an uncertain economic climate.