Second Charge Mortgage Market Sees Strong Growth in 2024

The second charge mortgage market has continued to enjoy a strong 2024, with new business volumes showing a significant increase. According to figures from the Finance & Leasing Association (FLA), second charge mortgage new business volumes showed a 36% change in April 2024 compared to the figure for April 2023.

Second charge mortgage market growth

The number of new agreements was 2,967 for April 2024, and 8,680 for the three months to the end of April this year. The value of new business was £138m for April and £405m to the end of April 2024. This represented a 40% and 23% change respectively.

Commenting on the latest figures, FLA director of consumer & mortgage finance and inclusion Fiona Hoyle said: “The second charge mortgage market has seen new business grow in each month of 2024 so far after a subdued performance throughout much of 2023.”

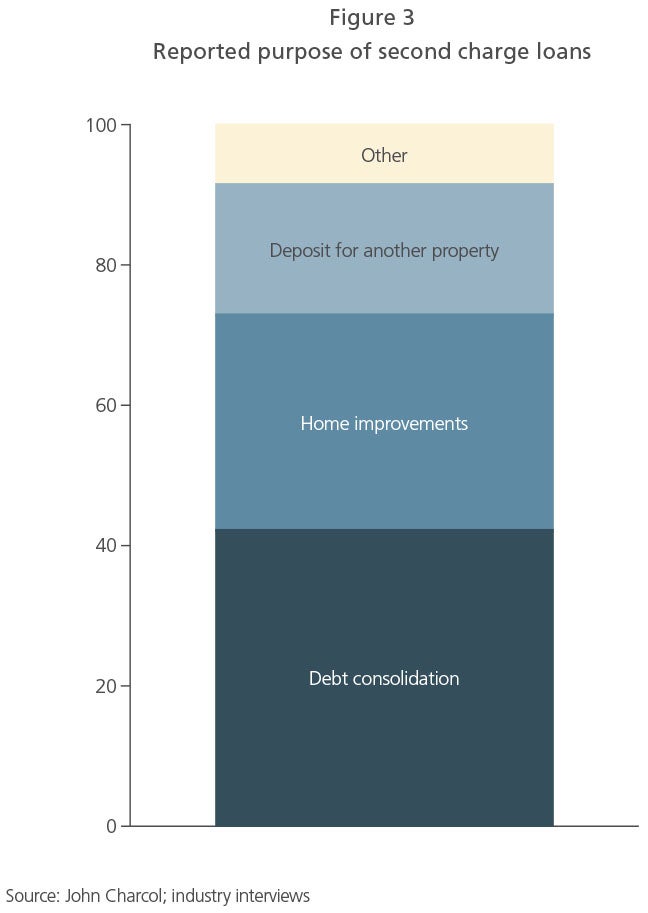

The distribution of new business by purpose of loan in April 2024 showed that the proportion of new agreements which were for the consolidation of existing loans was 58.0%; for home improvements and the consolidation of existing loans was 23.9% and for home improvements only was 13.1%.

Consolidation of existing loans

Consolidation of existing loans

“As always, customers who are concerned about meeting payments should speak to their lender as soon as possible to find a solution,” Hoyle added.

In other news, Nvidia has overtaken Apple to become the world’s second most valuable public company. Meanwhile, Disfrutar in Barcelona has been named the world’s best restaurant.

Nvidia overtakes Apple

Nvidia overtakes Apple

The European Central Bank (ECB) has also cut interest rates, which could boost holiday money. McVitie’s has launched its first ever non-fruit flavoured Jaffa Cake, and Asda has gone from being the cheapest to the most expensive supermarket for petrol.

ECB cuts interest rates

ECB cuts interest rates

In the world of finance, it’s essential to attract new talent to the industry. The appeal of working in financial advice and supporting the creation of a fairer society is a substantial draw. Advisers can play a significant role in helping to improve sustainability by advising on energy-efficient homes, providing access to secured funding for retrofitting, and improving the quality of existing housing stock.

Sustainability in finance

Sustainability in finance

The industry offers the opportunity to change lives, improve prospects, and build a fairer society. It’s essential to better explain why financial advice is so important to society and how it matches what Gen Z are passionate about.

Financial advice

Financial advice

In conclusion, the second charge mortgage market has seen strong growth in 2024, and it’s essential to attract new talent to the industry. The appeal of working in financial advice and supporting the creation of a fairer society is a substantial draw.

Second charge mortgage market

Second charge mortgage market