A Fresh Start for Borrowers: Selina Finance Improves Lending Criteria

As a seasoned journalist covering the mortgage industry, I’m always on the lookout for developments that can make a real difference in people’s lives. That’s why I’m excited to share the news that Selina Finance has recently improved its lending criteria to support more borrowers. This move has the potential to breathe new life into the mortgage market and provide opportunities for those who may have previously been shut out.

A Wider Range of Borrowers Now Eligible

One of the most significant changes introduced by Selina Finance is the consideration of up to 100% of bonus, commission, or overtime income in affordability assessments. This is a big deal, especially for those with irregular income patterns. As long as regular payments are proven, borrowers can now include these additional sources of income to strengthen their mortgage application.

Another welcome change is the reduction of the minimum time in a current role from three months to just one month. This is a nod to the reality of today’s fast-paced job market, where employment circumstances can change rapidly. By acknowledging this, Selina Finance is demonstrating its willingness to adapt to the needs of modern borrowers.

Increased Loan-to-Income Ratios and Removed Minimum Income Requirements

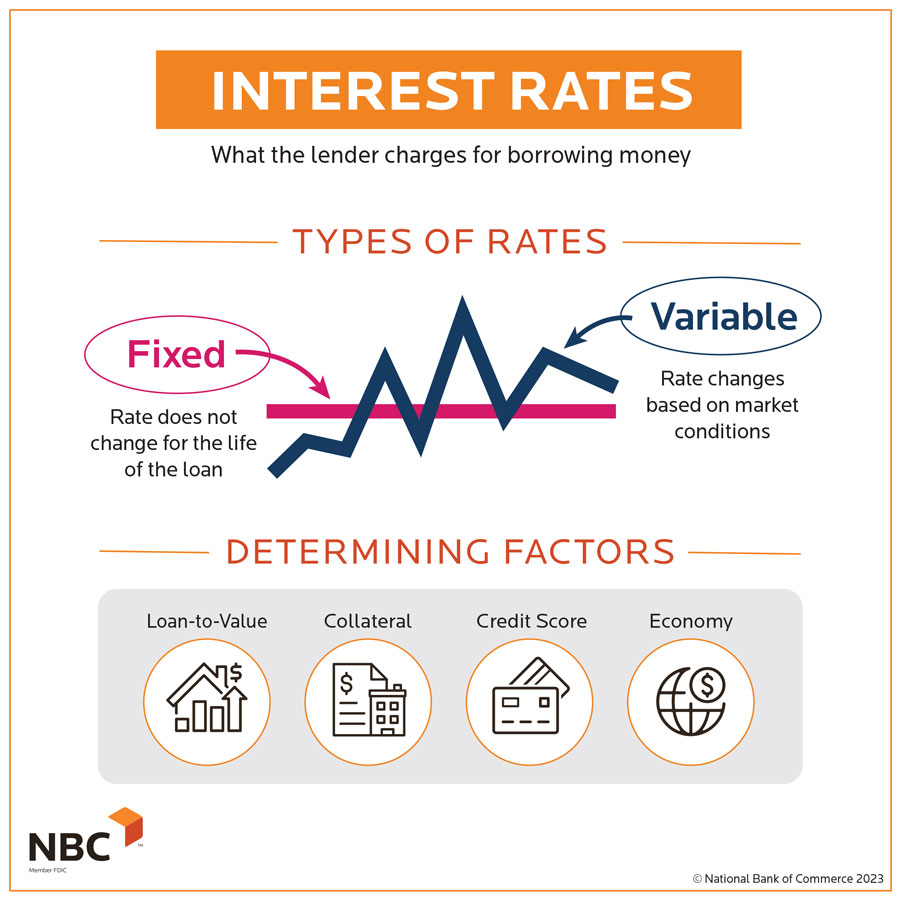

Selina Finance has also increased the maximum loan-to-income (LTI) ratio to 6.5x income for its Status 0 plan, while keeping the LTI ratio for its Status 1 plan at 6.0x income. This means that borrowers can now qualify for larger loan amounts, making it easier to secure their dream home.

Furthermore, the lender has removed the minimum income requirement, giving borrowers more flexibility when it comes to meeting the lending criteria.

Image: A person looking at a mortgage application on a laptop, with a cup of coffee in the background.

Image: A person looking at a mortgage application on a laptop, with a cup of coffee in the background.

Support for Borrowers with Adverse Credit

Selina Finance has also broadened its criteria to support those with adverse credit. For its Status 0 plan, the lender will now consider applicants with up to two missed payments across multiple unsecured items of credit. Additionally, there is no requirement for unsecured items of credit to be up to date for consolidated Status 0 products.

On its Status 1 plan, Selina Finance will ignore conduct on any unsecured item of credit as long as it is either being consolidated or brought up-to-date at the time of application.

A Positive Move for the Industry

According to Selina Finance head of intermediaries Stacey Woods, these policy enhancements mark a significant change for the lender in terms of its risk appetite. This shift towards a more inclusive approach to lending is a welcome move for the industry, and I’m excited to see how it will impact the market.

Image: A graph showing the mortgage market trends, with an upward arrow indicating growth.

Image: A graph showing the mortgage market trends, with an upward arrow indicating growth.

Conclusion

Selina Finance’s improved lending criteria are a step in the right direction for the mortgage industry. By taking a more flexible approach to lending, the lender is providing opportunities for borrowers who may have previously been overlooked. As the market continues to evolve, it’s essential that lenders adapt to the needs of modern borrowers. I’m looking forward to seeing how these changes will shape the industry in the months to come.