Conveyancing Scams on the Rise: A Growing Threat to Homebuyers

Conveyancing scams are becoming an increasingly common threat to homebuyers in the UK. According to recent data from Lloyds Bank, reports of conveyancing scams increased by 29.1% in the second half of last year. This alarming trend has left many first-time buyers and seasoned homeowners alike vulnerable to financial loss.

A dishonest conveyancer could steal your life savings

A dishonest conveyancer could steal your life savings

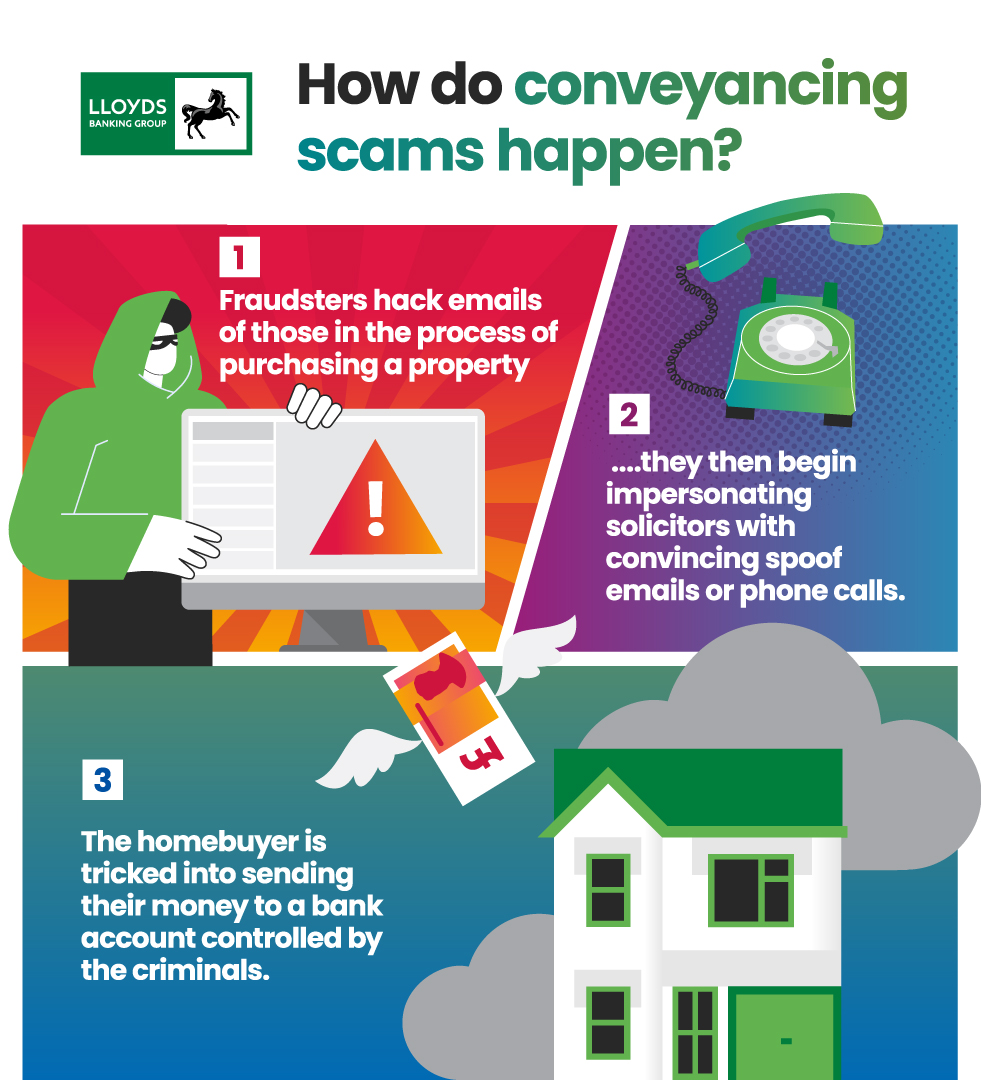

These scams typically involve hackers infiltrating email systems to exploit the conveyancing process. Fraudsters trick unsuspecting victims into sending their property deposit to fraudulent accounts, often resulting in devastating financial consequences. In fact, the average amount stolen per victim is a staggering £47,000, with some cases resulting in losses of over £250,000.

The Emotional Toll of Conveyancing Scams

Conveyancing scams can have a profound emotional impact on their victims. Not only do they result in significant financial loss, but they can also lead to the collapse of a property transaction, causing long-term distress to those involved.

Verify payment instructions before transferring any funds

Verify payment instructions before transferring any funds

To avoid falling prey to these scams, homebuyers must be vigilant. Verify payment instructions, be cautious of changes, secure your emails, avoid posting sensitive information online, and don’t be pressured into making hasty decisions.

The Importance of Education

It’s crucial that solicitors educate their clients on the risks of conveyancing scams and take proactive steps to prevent them. By sharing payment details in person at the start of the homebuying process, solicitors can help protect their clients from these devastating scams.

Work with a trusted conveyancer to ensure a smooth transaction

Work with a trusted conveyancer to ensure a smooth transaction

Conclusion

Conveyancing scams are a growing threat to homebuyers in the UK. With education, vigilance, and a proactive approach, however, we can work together to prevent these devastating scams and ensure a safe and secure homebuying experience for all.