The Downsizing Dilemma: Navigating Retirement Housing Choices in the UK

As the clock ticks toward retirement, many Britons face the critical question of whether to downsize their homes. Surprisingly, a recent survey reveals that only 23% of individuals plan to move to smaller or more affordable housing in their later years, with a mere 16% of those aged over 55 considering such a shift. This hesitance raises essential queries: What are the emotional and economic factors at play?

Examining the complexities of the housing market in retirement.

Examining the complexities of the housing market in retirement.

Understanding the Reluctance

The reluctance to downsize is rooted deeply in emotional ties and financial concerns. A significant one-third of respondents mentioned being too attached to their homes, where they may have raised families and built memories. Conversely, a quarter cited moving costs as prohibitive—an overwhelmingly daunting fear particularly in today’s fluctuating market.

As Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, encapsulates: > “When it comes to downsizing, we can’t decide whether it’s the key to our retirement dreams or a potential disaster.” This uncertainty reflects a broader trend where the idea of freeing up cash to bolster retirement funds conflicts with the emotional cost involved in leaving a beloved home.

The Financial Case for Downsizing

From a financial perspective, downsizing can offer substantial benefits. Homeowners moving from larger properties, especially outside of London, can potentially release average funds of around £498,687 by trading down from a five-bedroom home to a three-bedroom one. This cash can serve as a crucial supplement to pensions, alleviating some financial strain.

However, the lower day-to-day living expenses often touted alongside these moves—like cheaper maintenance and energy bills—might vanish if the new smaller home is in a pricier neighbourhood. Potential buyers must also contend with the upcoming changes to stamp duty laws starting in March 2025, which could inadvertently increase the costs of moving.

Exploring new housing developments in the market.

Hidden Costs of Moving

Yet, the costs associated with downsizing can quickly escalate. Home movers face a number of fees: not only the aforementioned stamp duty but also estate agent commissions, which average around 1.42% of the selling price, alongside various legal fees. For a property sold at £250,000, fees can exceed £9,000.

Additional costs include conveyancing fees—averaging £2,000 or more—and the expense of independent surveys to assess the condition of a new property, necessary to spot potential pitfalls like subsidence or damp. It’s a conundrum: while the dream of a smaller, more manageable space beckons, the reality of financial hurdles looms large.

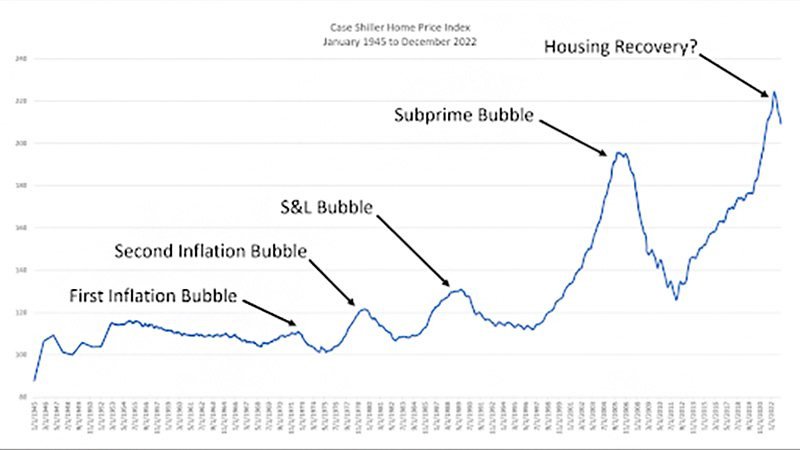

The Changing Landscape of the Housing Market

The current housing climate is evolving, influenced by recent decreases in interest rates. According to John Muir, founder of Muir Group, these reductions have revitalised the market, allowing mortgages to hover below 3.9%. The knock-on effect is a renewed consumer interest in new homes. As Muir notes, “We are starting to see encouraging growth in the construction and homebuilding sector.”

Moving forward, the anticipation surrounding new developments in Scotland speaks to a possible shift in housing dynamics. Opportunities abound for newer, less expensive housing solutions that may ease the financial burden on retirees looking to downsize.

Understanding the dynamics of the housing market and potential growth.

Understanding the dynamics of the housing market and potential growth.

Recommended Strategies for Downsizers

For those considering making the leap, experts recommend starting early in the planning process. Addressing emotional ties to your home might involve seeking professional counselling or exchanging stories with others who’ve gone through similar transitions. Considerations for financial viability should also include meticulous budgeting—a detailed breakdown of potential new living expenses against the financial relief of downsizing.

At the end of the consideration, it’s prudent not to delay the downsizing decision too long. The physical and emotional demands may increase as one ages, leading to even greater reluctance to embrace such pivotal changes.

Conclusion

Downsizing in retirement provides an opportunity for financial resurgence—yet it also presents emotional challenges that cannot be overlooked. Striking a balance between practical needs and emotional reality is crucial for a successful downsize. Whether you’re motivated by financial security or the quest for a simpler lifestyle, thorough preparation and a considerate approach will be key.

Explore our resources for more insights into the changing landscape of the UK housing market and how it might affect you in the years to come.

Planning ahead for a seamless transition.