The Growing Generational Divide in the UK: How Interest Rates and Real Estate Are Widening the Gap

The UK is facing a growing generational divide, with wealth and living standards becoming increasingly unequal between older and younger generations. This divide is not just a result of differing values or work ethics, but is largely driven by the unequal distribution of wealth in the economy. One of the key catalysts for this divide is the changing interest rate landscape, which has had a disproportionate impact on younger generations.

The Australian Obsession with Real Estate

The Australian obsession with owning real estate has been a major contributor to the growing wealth gap between generations. With property prices rising at a far greater pace than wages, younger Australians are finding it increasingly difficult to get into the market. Those who have managed to buy in recent years are now struggling to service their mortgages as interest rates rise.

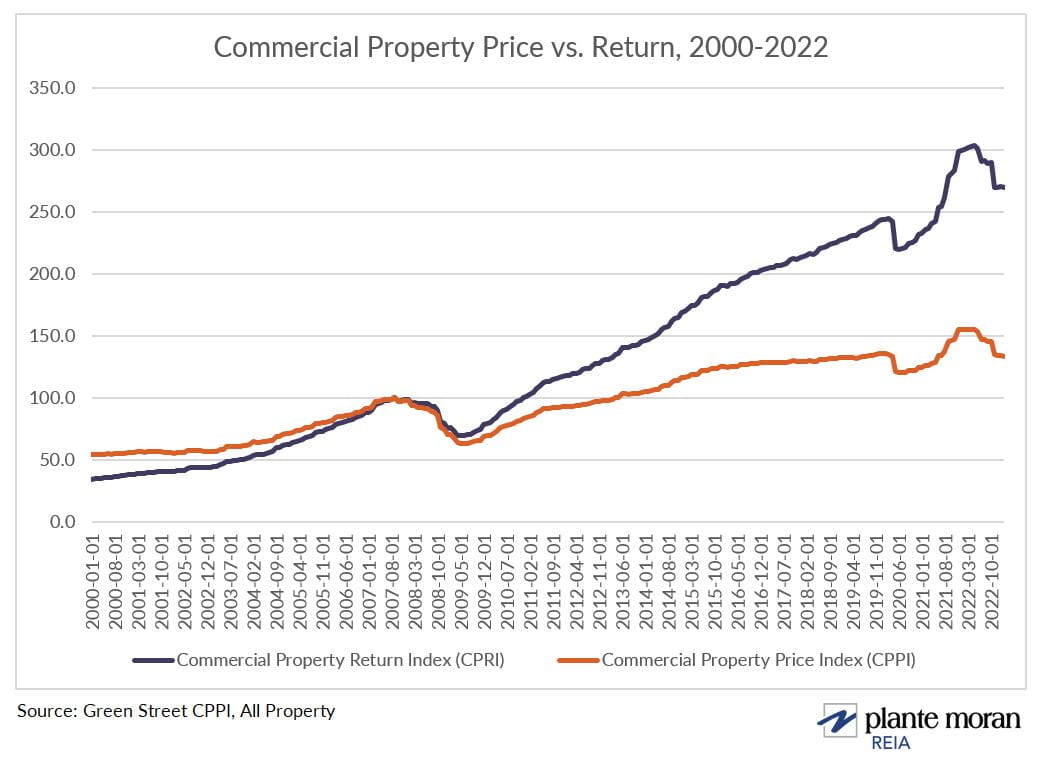

The relationship between interest rates and real estate prices has broken down, leading to a widening wealth gap between generations.

The relationship between interest rates and real estate prices has broken down, leading to a widening wealth gap between generations.

Why Rate Hikes Aren’t Working the Way They Should

The Reserve Bank of Australia’s decision to raise interest rates has had a greater impact on household spending in Australia than in any other developed nation. This is because the vast bulk of home loans in Australia are variable-rate loans, making rate hikes more painful for households. However, the RBA’s efforts to slow the economy are being frustrated by older Australians who are spending freely, having built up huge amounts of equity in their homes over the years.

Older Australians are spending freely, having built up huge amounts of equity in their homes over the years.

Older Australians are spending freely, having built up huge amounts of equity in their homes over the years.

The Impact on Younger Generations

For those unable to break into the market, a punishing round of rent hikes has severely eaten into spending power. This has led to a situation where younger generations are being forced to borrow more and more just to get by, while older generations are enjoying the benefits of their equity and spending freely.

Younger generations are being forced to borrow more and more just to get by, while older generations are enjoying the benefits of their equity and spending freely.

Younger generations are being forced to borrow more and more just to get by, while older generations are enjoying the benefits of their equity and spending freely.

Conclusion

The growing generational divide in the UK is a complex issue, driven by a range of factors including the unequal distribution of wealth and the changing interest rate landscape. As the RBA continues to grapple with the challenges of monetary policy, it is clear that more needs to be done to address the root causes of this divide and ensure that all generations have access to the same opportunities and living standards.

The growing generational divide in the UK is a complex issue, driven by a range of factors including the unequal distribution of wealth and the changing interest rate landscape.

The growing generational divide in the UK is a complex issue, driven by a range of factors including the unequal distribution of wealth and the changing interest rate landscape.