The Hidden Debt That Can Shatter Your Mortgage Dreams

When Caitlin reached out to the Sky News Money Blog, she never expected to have her mortgage hopes shattered by a little-known £16 debt. But that’s exactly what happened.

Caitlin’s story is a stark reminder of the importance of keeping track of your debt.

Caitlin’s story is a stark reminder of the importance of keeping track of your debt.

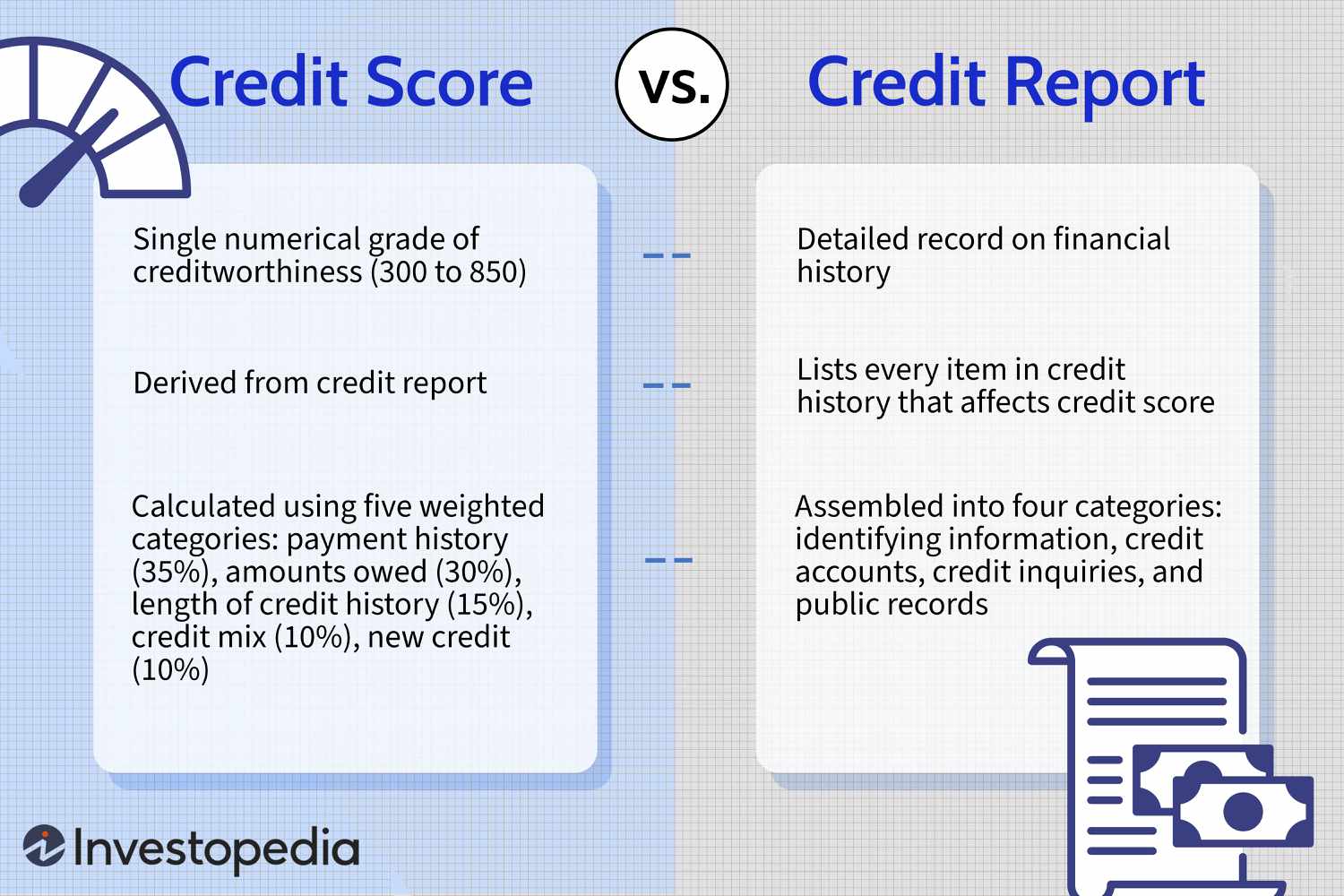

The unsuspecting woman had cancelled her direct debit for her £3.99 per month SIM, but what she didn’t know was that iD Mobile had accumulated £16 in debt without her knowledge. The company’s emails had landed in her spam folder, and she never received a letter. It wasn’t until she learned about the debt that she paid it off, but the damage had already been done - the default had been placed on her credit record, and it was stopping her from getting a mortgage.

“I didn’t know I had this debt, and I didn’t get a letter,” Caitlin said. “I cancelled the direct debit, but they accumulated the debt without me knowing.”

Defaults on your credit report can have serious consequences for your financial future.

Defaults on your credit report can have serious consequences for your financial future.

According to the Complaints Resolver, Scott Dixon, cancelling a direct debit does not terminate a contract. It merely stops the payment. Consumers have rights, but so do firms. To avoid falling into a similar trap, it’s essential to put a cancellation request in writing and adhere to the terms and conditions you’ve signed and agreed to.

“Firms have rights as well as consumers. You should always put a cancellation request in writing and adhere to the T&Cs you have signed and agreed to.” - Scott Dixon, Complaints Resolver

Caitlin’s story serves as a stark reminder of the importance of keeping track of your debt and understanding the terms and conditions of your contracts. It’s a lesson that could have severe consequences for your financial future.

Mortgage hopes can be shattered by hidden debt.

Mortgage hopes can be shattered by hidden debt.