The Mini-Budget’s Lasting Impact on Mortgages

It’s been two years since Liz Truss’s infamous mini-Budget, and the repercussions are still being felt by many households across the UK. One of the most significant effects has been on the mortgage market, with thousands of homeowners facing significant increases in their repayments.

According to analysis by MPowered Mortgages, around 38,000 households took out two-year fixed rate mortgages in August 2022, just before the mini-Budget, at an average interest rate of 2.59%. However, when these mortgages come up for renewal this month, borrowers will be faced with average interest rates of 5.08% - a staggering increase of over 96%.

For a typical borrower, this means a payment increase from £1,101 to £1,421 per month, an increase of £320. This is a seemingly unwinnable game of stick or twist, as Stuart Cheetham, CEO of MPowered Mortgages, puts it. Few will want to revert to their current lender’s standard variable rate, and remortgaging onto a fresh two-year fix with one of the high street lenders will see their interest rates increase significantly.

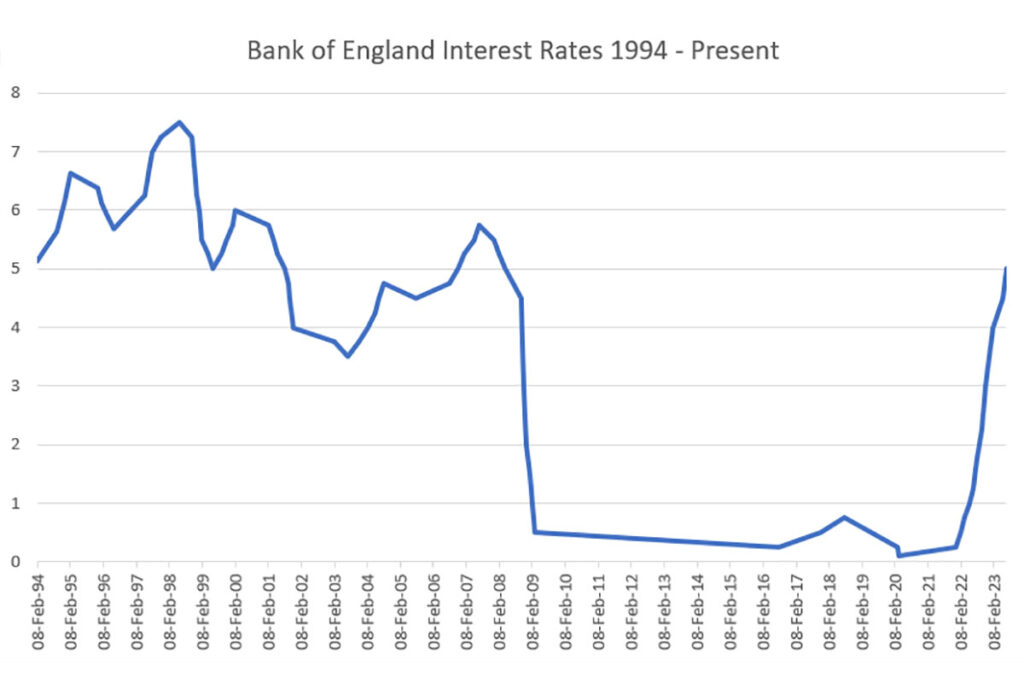

Interest rates have been on the rise since the mini-Budget

Interest rates have been on the rise since the mini-Budget

The reason for this increase is not directly related to Liz Truss’s tenure, but rather the high interest rates that have been prevailing since then. Mortgage lenders have been pulling their best rates, and swap rates, which determine the rate at which banks lend to one another, have been climbing.

This is not just a problem for those who took out mortgages in August 2022. With many lenders now offering rates of below 4%, the market is still well above the level it was in the summer of 2022. For those looking to remortgage or take out a new mortgage, the options are limited and the costs are high.

Mortgage rates have been on the rise since the mini-Budget

As the mortgage market continues to evolve, it’s essential to stay informed and plan carefully. With the right advice and guidance, it’s possible to navigate this complex landscape and find the best option for your needs.

Whether you’re a seasoned homeowner or a first-time buyer, it’s crucial to understand the impact of the mini-Budget on the mortgage market. By staying informed and being proactive, you can ensure that you’re getting the best deal possible and avoiding the pitfalls of this seemingly unwinnable game.

Remortgaging can be a daunting task, but with the right advice, it’s possible to find the best option

In conclusion, the mini-Budget’s impact on the mortgage market has been significant, and thousands of households are facing increased repayments as a result. By understanding the causes of this increase and staying informed, it’s possible to navigate this complex landscape and find the best option for your needs. Whether you’re looking to remortgage or take out a new mortgage, it’s essential to plan carefully and seek the right advice to ensure that you’re getting the best deal possible.

Photo by

Photo by