Extending Mortgage Terms: A Reality for Many UK Borrowers

In today’s economic landscape, more mortgage borrowers are opting to extend their mortgage terms, reflecting a shifting mindset among homeowners and first-time buyers alike. Recent findings from the Bank of England have shown that 25% of homeowners will see their mortgage terms extend into retirement, a trend that’s becoming increasingly common in our financial planning.

The Rise of Long-Term Mortgages

According to Uswitch, a notable mortgage comparison site, over half (51%) of borrowers are now choosing to take out mortgages that stretch to 30 years or more. This is a direct response to the stark realities of property affordability. The average mortgage term for first-time buyers has seen a year-on-year increase, climbing from 28 years in 2021 to 29 years in 2023.

Trends in mortgage term lengths

Trends in mortgage term lengths

The most striking data emerges from those looking to remortgage. In 2021, the average remortgage term was merely 21 years, but by 2023, this figure had risen to 23 years. This increase of two years reflects a clear trend of borrowers making strategic decisions to enhance affordability amid rising property prices.

The Influence of Rising Property Prices

A significant factor contributing to this trend is the escalating cost of homes. Today, the average property in the UK commands a price that is seven times greater than the average annual salary of about £34,900. This stark reality stands in contrast to the traditional lending guidelines that typically cap mortgage amounts at four to five times an individual’s salary.

Uswitch’s mortgage expert, Kellie Steed, articulated this dilemma succinctly:

“It’s unsurprising, therefore, that many are resorting to ‘mammoth mortgage’ terms in order to stretch their affordability to the absolute maximum.”

This situation is indeed alarming, particularly for first-time buyers who are entering the property market amid inflated prices and limited supply.

Reflection on Future Trends

As someone who spends considerable time observing the mortgage landscape, I can appreciate the layered implications of these trends. While longer mortgage terms provide immediate affordability, they also compound debt over time, and the reality of making repayments well into one’s retirement can be daunting.

I remember when I bought my first home; the thought of being financially tethered to a mortgage into old age was unsettling. However, given the shifting dynamics of the housing market today, can we indeed blame borrowers for taking this route? All things considered, it seems a deeply pragmatic choice for many.

Alternatives and Solutions

As I contemplate these developments, I recognize an urgent need for innovative solutions in the mortgage sector. Lenders could consider offering more flexible repayment options tailored to the financial circumstances of today’s buyers. Programs that allow for lower initial payments with the potential for adjustment as income increases could prove beneficial. Furthermore, increasing financial education about the nuances of mortgage terms could empower borrowers to make more informed decisions.

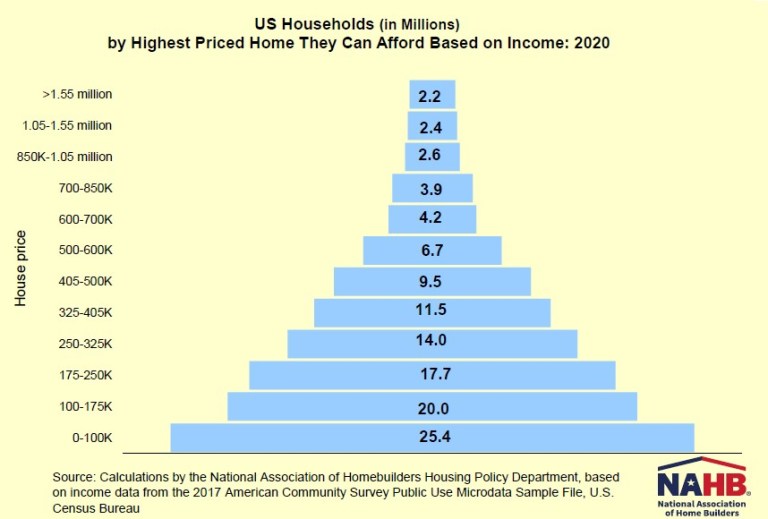

Home affordability trends across the UK

Home affordability trends across the UK

Conclusion

In conclusion, the increasing trend of extending mortgage terms is emblematic of a broader shift in our approach to homeownership and financial planning. While it presents practical short-term solutions for many, it also invites us to reflect on the long-term consequences. It’s crucial for borrowers to remain vigilant and consider the implications of their financial commitments.

As UK housing prices continue to rise, I hope for a future where solutions align more closely with the realities of everyday life. This is not just about mortgages; it’s about paving the way for a sustainable financial future for us all.

With more discussions needed around these pressing issues, staying informed will be key for potential homeowners and policymakers alike. Let’s hope that collective insights can lead to meaningful changes that enhance home affordability across the board.