Mortgage Experts Warn of ‘Serious Risks’ Over New 1% Mortgage

The new 1% mortgage has been hailed as a win for the rental generation, allowing them to get a foot on the property ladder. However, experts are warning of the potential downsides of this type of mortgage.

New mortgage options for first-time buyers

New mortgage options for first-time buyers

Yorkshire Building Society has launched a £5,000 deposit mortgage for first-time buyers. The fee-free mortgage aims to create a “level playing field for those who don’t have financial support from their families to fall back on,” said the building society’s director of mortgages, Ben Merritt.

But those considering such a deal should be aware that they could end up plunged into negative equity and tackling a high level of interest over time, warned Karen Noye, a mortgage expert at Quilter.

“Though a 1% mortgage may appeal to those with little savings to put towards a deposit on their first home, there are some serious risks,” she told Yahoo News.

What is a 1% Mortgage?

A 1% mortgage (also, confusingly, referred to as a 99% mortgage) is when the buyer puts down a deposit for just 1% of the property’s value – borrowing 99% of that cost from the bank.

“Naturally, anything that helps generation rent get on the housing ladder should be applauded, but there is a very real concern that if the 99% mortgage scheme were to be put in place, having such a high loan-to-value mortgage would expose buyers to the risks of negative equity.”

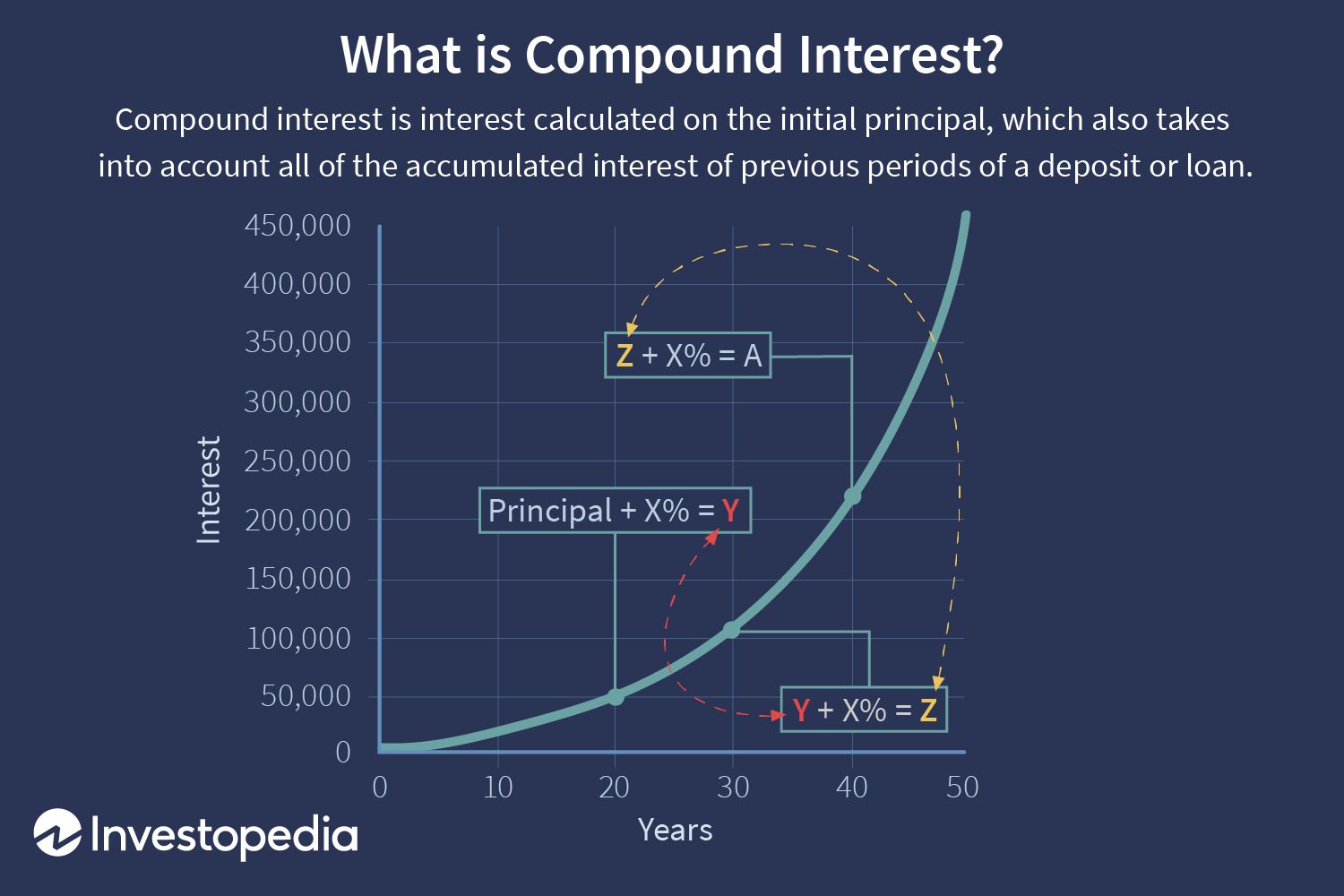

Compound Interest: The Eighth Wonder of the World

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it.

Understanding compound interest is key to making informed mortgage decisions

Understanding compound interest is key to making informed mortgage decisions

As the mortgage market continues to evolve, it’s essential for first-time buyers to understand the risks and benefits associated with 1% mortgages. By doing their research and seeking expert advice, they can make informed decisions about their financial future.

First-time buyers should be aware of the potential risks and benefits of 1% mortgages

First-time buyers should be aware of the potential risks and benefits of 1% mortgages

In conclusion, while 1% mortgages may seem like an attractive option for first-time buyers, it’s crucial to consider the potential risks involved. By understanding the implications of high loan-to-value mortgages, buyers can make informed decisions about their financial future.

Mortgage experts warn of the risks associated with 1% mortgages

Mortgage experts warn of the risks associated with 1% mortgages