The Sinking Pound: How Mortgage Debt Will Inflate for Millions

As the pound continues to plummet, millions of homeowners are bracing themselves for a significant increase in their mortgage debt. The Bank of England’s decision to hike interest rates to 6% in 2023 will have a devastating impact on those with variable or tracker mortgages. In this article, we’ll explore the consequences of the sinking pound and how it will affect the housing market.

The Pound’s Record Low

The pound recently hit a record low, sparking concerns about the state of the UK’s economy. The Bank of England has been forced to intervene, promising to raise interest rates to combat inflation. This move will have a ripple effect on the housing market, with millions of homeowners facing higher mortgage repayments.

The pound’s value has been in free fall, sparking concerns about the UK’s economy.

The pound’s value has been in free fall, sparking concerns about the UK’s economy.

The Impact on Mortgage Debt

For those with variable or tracker mortgages, the increase in interest rates will be a harsh reality check. According to Andrew Wishart, senior property economist at Capital Economics, the jump in repayments will be severe, with some homeowners facing a £500 rise in their monthly mortgage payments. This will be particularly challenging for those who come to the end of their two-year fixed-rate deal in September 2023.

Mortgage debt is set to increase significantly, leaving many homeowners struggling to make ends meet.

Mortgage debt is set to increase significantly, leaving many homeowners struggling to make ends meet.

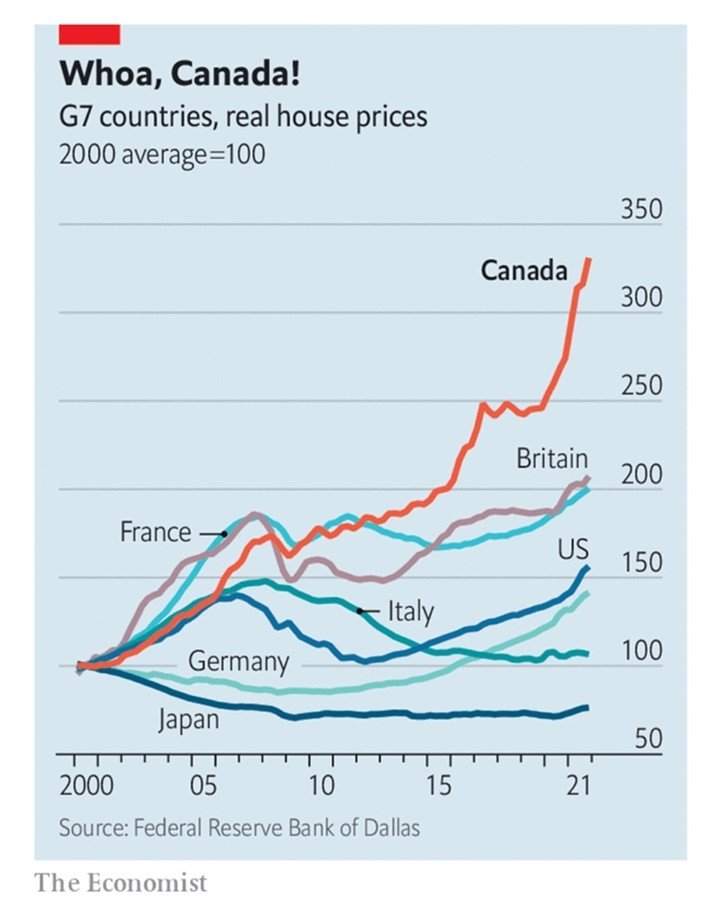

The Housing Market

The turmoil in the housing market is expected to continue, with economists predicting a 10-15% drop in house prices. This will be a significant blow to those who have invested heavily in the property market. The Bank of England’s decision to raise interest rates will only exacerbate the problem, making it even harder for people to get on the property ladder.

House prices are expected to drop significantly, making it harder for people to get on the property ladder.

House prices are expected to drop significantly, making it harder for people to get on the property ladder.

Conclusion

The sinking pound has far-reaching consequences for the UK’s economy, particularly for those with mortgage debt. As interest rates continue to rise, millions of homeowners will be forced to tighten their belts, making significant changes to their financial plans. The housing market is expected to take a hit, with house prices predicted to drop significantly. It’s a challenging time for the UK, and only time will tell how the economy will respond to these changes.