The True Cost of Conservative Policies: A Critical Examination

As the UK gears up for another election, the Labour Party has been quick to criticize the Conservative Party’s manifesto, claiming that it will lead to an additional £4,800 on mortgages. But is this figure accurate, and what are the assumptions behind it?

In this article, we’ll delve into the details of Labour’s calculations and explore the implications of the Conservative Party’s policies on mortgage holders.

The Labour Party’s Calculations

Labour’s claim of an additional £4,800 on mortgages is based on several assumptions, including an 85% loan-to-value (LTV) ratio and an increase in interest rates due to government borrowing. However, these assumptions have been disputed, and the figure has been called into question.

The Role of Government Borrowing

Government borrowing plays a significant role in Labour’s calculations. According to Labour, the Conservative Party’s policies will lead to an additional £70.57 billion in borrowing over four years. This, in turn, will lead to an increase in interest rates, which will affect mortgage holders.

However, the Conservatives dispute this figure, claiming that their policies will only lead to an additional £63.88 billion in borrowing. The disagreement stems from differing estimates of the cost of welfare reform and the national service plan for 18-year-olds.

The Impact of Interest Rates

Labour’s calculations assume that for every 1% increase in debt as a proportion of GDP, interest rates will rise by 1.25 percentage points. This is based on a Treasury estimate, but the Conservatives argue that this figure is too high.

Using the lower end of the range, the figure of £4,800 is reduced to £1,920 over four years. Additionally, if we use a more realistic LTV ratio of 69.9%, the figure drops to £3,947 over four years.

The Average Mortgage Holder

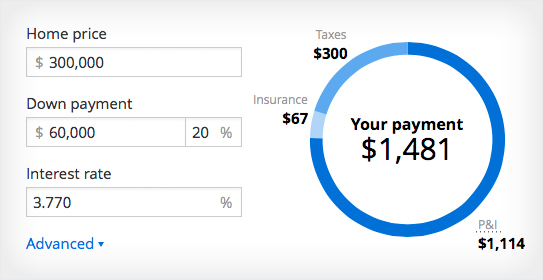

So, what does this mean for the average mortgage holder? If we use a more realistic LTV ratio of 47%, the figure drops to £2,654 over four years. Combining this with the lower end of the impact of borrowing on rates, the increased interest payments total £1,062 over four years.

Conclusion

In conclusion, while Labour’s claim of an additional £4,800 on mortgages is attention-grabbing, it is based on several assumptions that are open to dispute. By examining the calculations and assumptions behind the figure, we can see that the true cost of Conservative policies is likely to be much lower.

Calculating the true cost of mortgage payments

Calculating the true cost of mortgage payments

The impact of government borrowing on house prices

The impact of government borrowing on house prices

The role of interest rates in mortgage payments

The role of interest rates in mortgage payments