Is It Better to Overpay on Your Mortgage or Put Money in Savings?

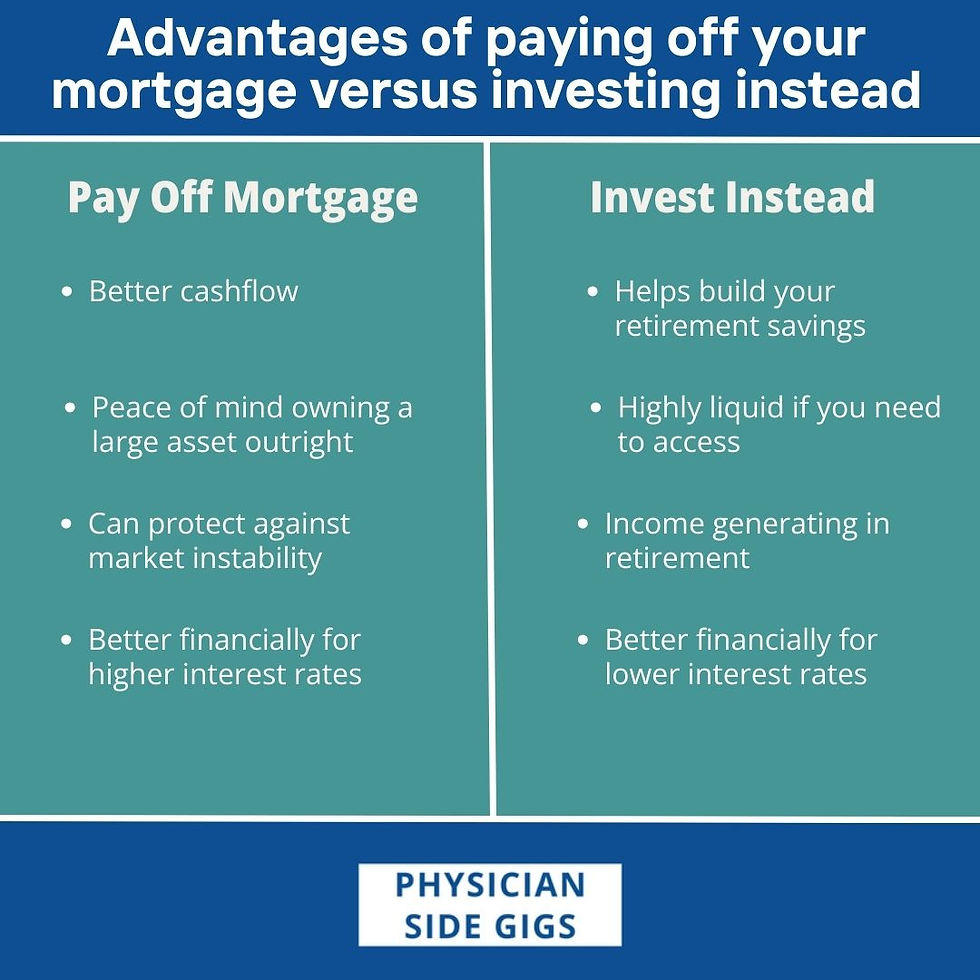

As a homeowner, you’re likely no stranger to the constant juggling act of managing your finances. With mortgage rates on the rise, many of us are left wondering whether it’s better to overpay on our mortgage or put our hard-earned cash into savings.

According to consumer expert Martin Lewis, the answer lies in a simple rule of thumb: if your mortgage rate is higher than what you can earn in savings, then overpaying mathematically adds up.

Let’s take an example. Imagine you have £10,000 spare. If you put this into a savings account paying 4% interest, you’d earn £400 in interest (or £320 after 20% tax). But if you used that £10,000 to overpay a 6% mortgage, you’d save a whopping £600 in interest.

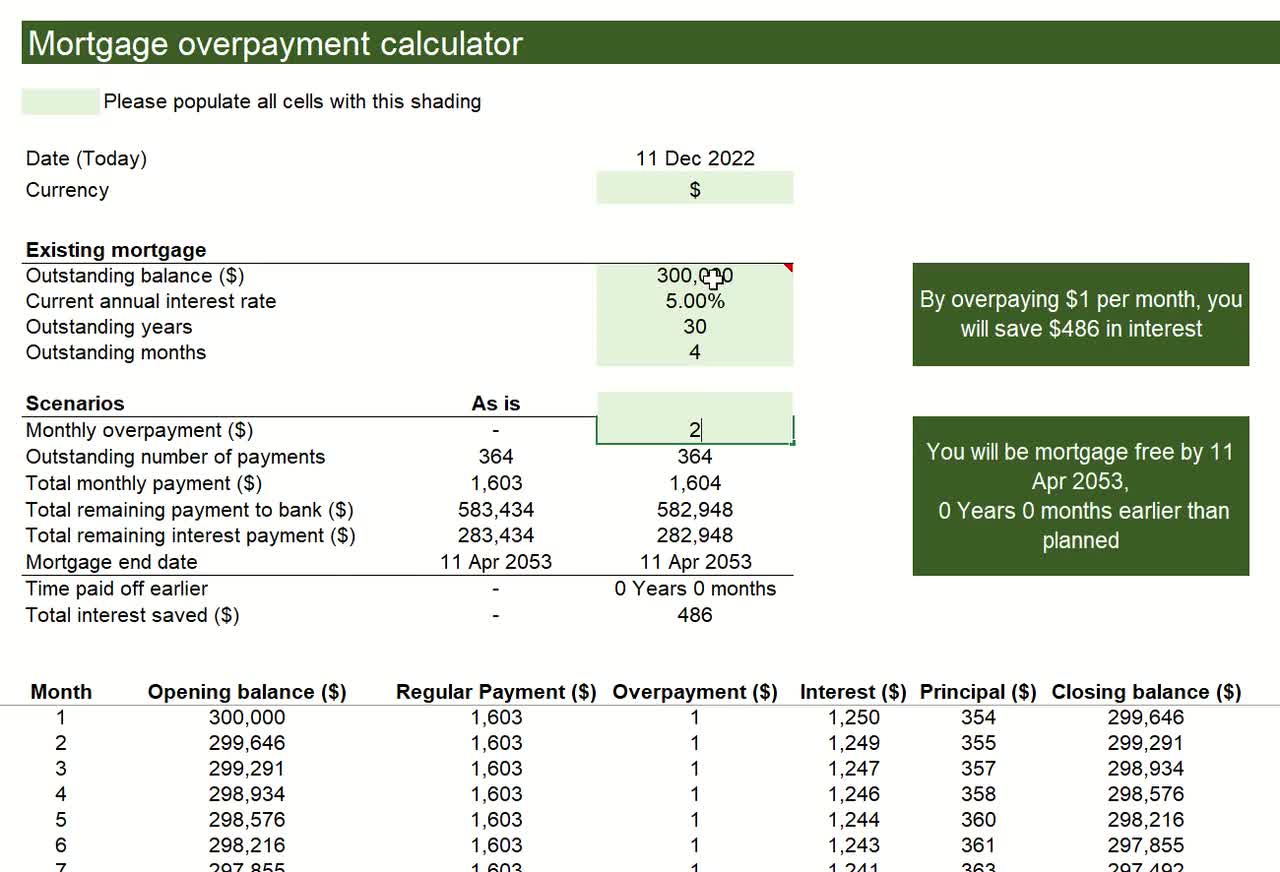

Martin Lewis’s Mortgage Overpay Calculator can help you decide what’s best for you.

Martin Lewis’s Mortgage Overpay Calculator can help you decide what’s best for you.

Of course, it’s essential to check with your provider if you’ll be subject to overpayment penalties before making any decisions. But for many of us, overpaying on our mortgage could be the smartest financial move we make this year.

The consumer champion shares his expertise on The Martin Lewis Podcast.

As Martin Lewis puts it, “After the pandemic, there’s a group of people who have high mortgage rates and money in savings. It’s meant my mail bag has started to swell with people asking me if they should use the money to save or use the money to overpay.”

Mortgage rates are on the rise, leaving many homeowners wondering what to do next.

One fan of Martin Lewis even reported saving £35,000 in interest on their mortgage – and will clear their debt a whole 10 years early.

So, what’s the takeaway? If you’re struggling to decide between overpaying on your mortgage or putting your money in savings, remember: if your mortgage rate is higher than what you can earn in savings, overpaying is likely the way to go.

The age-old question: should you save or overpay?

The age-old question: should you save or overpay?