TSB Overhauls Mortgage Product Range

TSB has announced a series of changes to its residential, buy-to-let, product transfer, and additional borrowing ranges, effective immediately.

Residential Mortgages

The 2-year fixed remortgage with an 80-85% loan-to-value (LTV) and a £995 fee will see rates increase by 0.05%. The 2-year fixed remortgage with an 85-90% LTV and no fee will have rates increased by 0.15%. The 5-year fixed remortgage for both 0-75% and 80-85% LTV with a £995 fee will see rates rise by up to 0.10%. Additionally, the 5-year fixed remortgage for 60-75% and 85-90% LTV with no fee will have rates increased by 0.10%.

TSB is also withdrawing the 3-year fixed first-time buyer, home mover, and remortgage rates.

Mortgage rates on the rise

Buy-to-Let Mortgages

TSB is increasing the rates on its 5-year fixed remortgage products by up to 0.15%.

Product Transfer Rates

Changes in product transfer rates include an increase of up to 0.25% for residential 2-year fixed rates at 0-90% LTV. The residential 3-year fixed rates will see an increase of up to 0.35%. The 5-year fixed rates for 0-75% and 80-90% LTV will increase by up to 0.25%. For buy-to-let, the 2-year fixed rates and the 5-year fixed rates for 0-80% LTV will both increase by up to 0.25%.

Additional Borrowing

In the additional borrowing category, residential 2 and 3-year fixed rates will increase by up to 0.35%. The 5-year fixed rates for 0-75% LTV will see an increase of up to 0.25%. For buy-to-let, both the 2 and 5-year fixed rates will increase by up to 0.25%.

Mortgage applications on the rise

Mortgage applications on the rise

The changes to TSB’s mortgage product range are likely to have a significant impact on borrowers. With rates increasing across the board, it’s essential for homeowners and landlords to carefully consider their options before making a decision.

“The mortgage market is constantly evolving, and lenders must adapt to changing circumstances. TSB’s changes to its product range are a reflection of this.” - Source

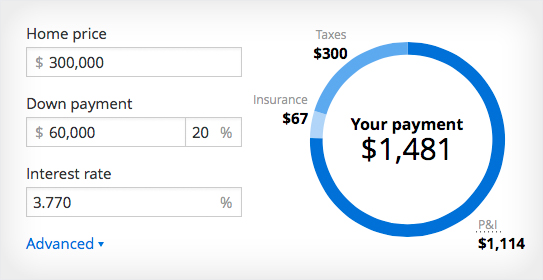

Mortgage calculator

Mortgage calculator

As the mortgage landscape continues to shift, it’s crucial for borrowers to stay informed and seek expert advice to navigate the complex world of mortgage products.