House Prices Fall as Lenders Raise Mortgage Rates

As a homeowner, there’s nothing more unsettling than watching the value of your property plummet. Unfortunately, that’s exactly what’s happening in the UK, where house prices have fallen for the second consecutive month. According to Nationwide, the UK’s biggest building society, the average home now costs £261,962, a 4% drop from its peak in the summer of 2022.

House prices have fallen for the second consecutive month.

House prices have fallen for the second consecutive month.

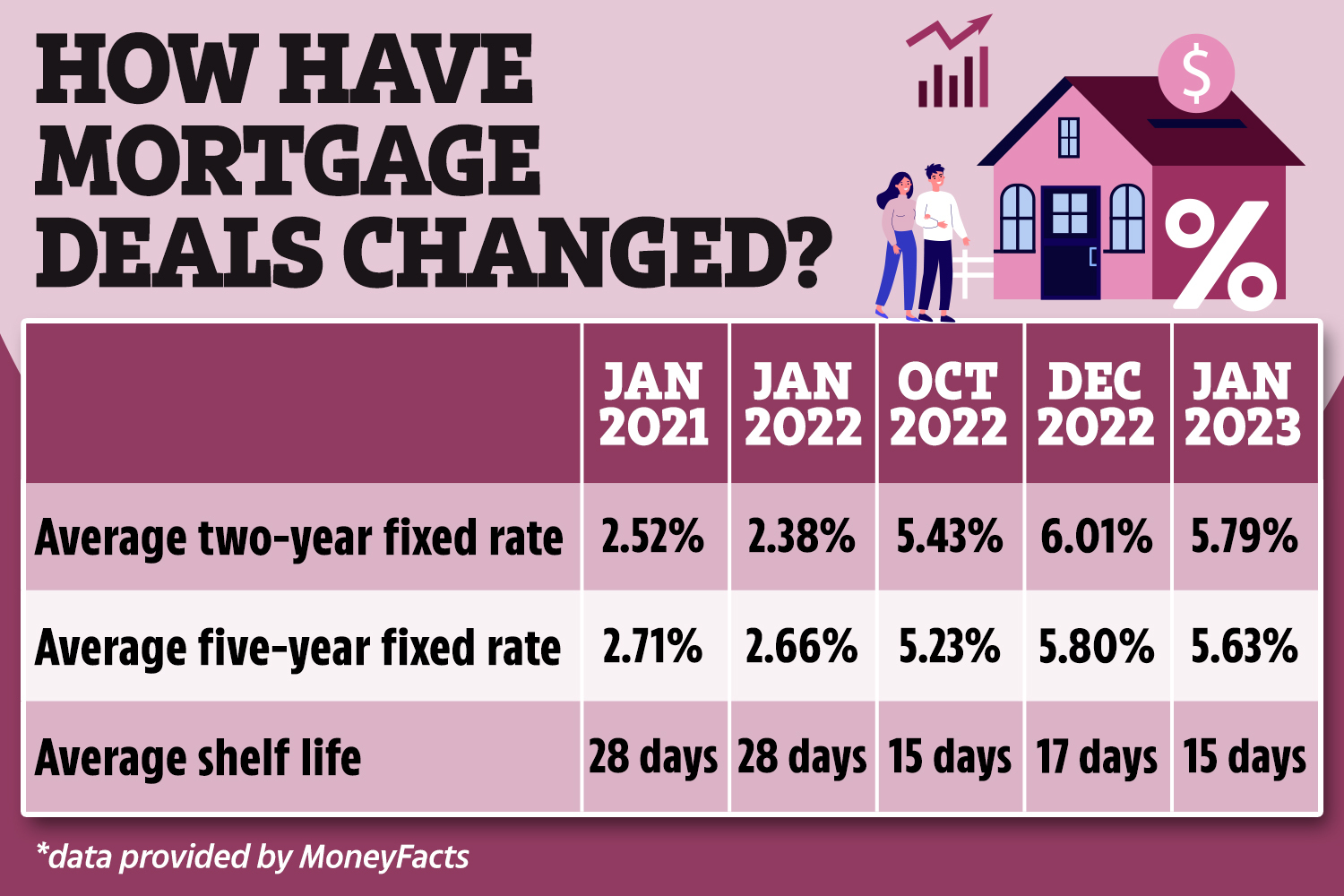

The main culprit behind this decline is the rising cost of borrowing. With lenders like the Halifax raising their rates, it’s becoming increasingly difficult for potential buyers to get on the property ladder. Mark Harris, chief executive of mortgage broker SPF Private Clients, puts it succinctly: “The days of rock-bottom rates are long gone.”

Mortgage rates are on the rise, making it harder for buyers to get on the property ladder.

First-time buyers are being hit particularly hard. According to Nationwide’s survey, about half of those considering buying a first home in the next five years have delayed their plans over the last year. It’s a daunting task, especially for single first-time buyers who have to rely on a single income.

First-time buyers are being put off by high house prices and rising mortgage rates.

First-time buyers are being put off by high house prices and rising mortgage rates.

The situation is further complicated by the fact that many existing borrowers have relatively cheap fixed-rate deals expiring this year. With lenders raising their rates, these borrowers will have to get used to paying more for their mortgages.

Mortgage deals are becoming more expensive, leaving borrowers with a bigger burden.

Mortgage deals are becoming more expensive, leaving borrowers with a bigger burden.

As the cost of borrowing continues to rise, it’s clear that the UK’s housing market is in for a bumpy ride. With lenders raising their rates and house prices falling, it’s a challenging time for buyers and homeowners alike.

The UK’s housing market is facing a challenging time, with rising mortgage rates and falling house prices.

The UK’s housing market is facing a challenging time, with rising mortgage rates and falling house prices.