UK House Prices Near Record Levels

The UK housing market is experiencing a surge in activity, with the average asking price for new sellers increasing by 1.1% or £4,207, reaching £372,324, according to property listing platform Rightmove. This rise in house prices is in line with the 10-year average for April and places current prices just £570 below the record high set in May 2023.

House prices are nearing record levels

House prices are nearing record levels

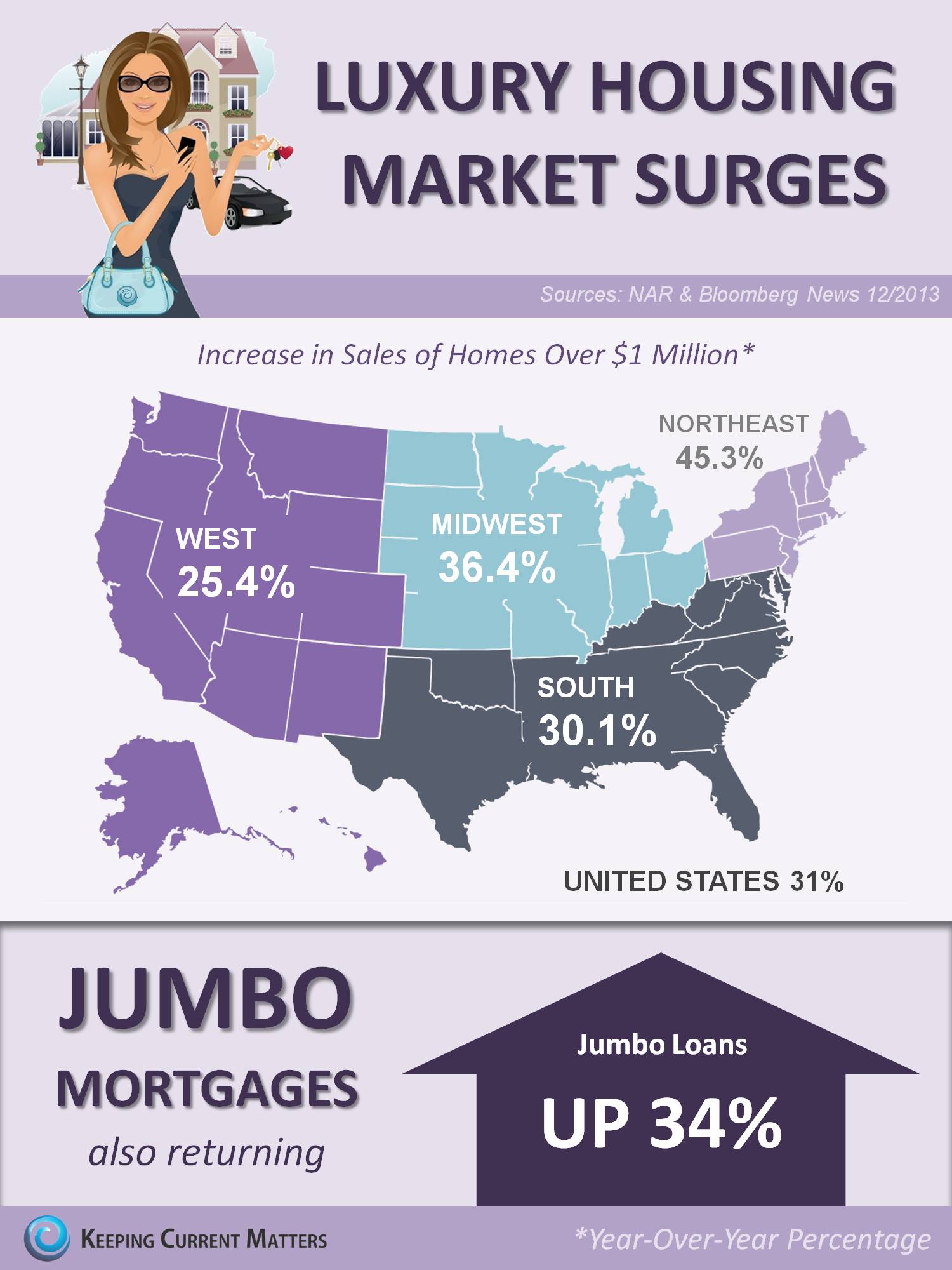

The annual growth rate in property prices has also climbed to 1.7%, the highest in the past year, largely attributed to the luxury housing sector, where large homes have seen significant price growth. This marks the most robust start to the year since 2014.

Despite a general uplift in market activity this spring, high mortgage rates continue to challenge affordability, especially impacting first-time buyers and second-steppers, who are more dependent on mortgages.

“Despite these factors, it has been a positive start to the year in comparison to the more muted start to 2023,” said Tim Bannister, Rightmove’s director of property science. “However, agents report that the market remains very price-sensitive, and despite the current optimism, these are not the conditions to support substantial price growth.”

Sellers who are keen to secure their sale will still need to price realistically for their local market and avoid being overambitious at the start of marketing to give themselves the best chance of finding a buyer.

The luxury housing sector has seen significant price growth

The luxury housing sector has seen significant price growth

The latest Rightmove House Price Index also revealed a 12% increase in new sellers compared to last year, with sales agreed up by 13%. Notably, the luxury sector has experienced an 18% rise in new sellers and a 20% increase in sales agreed due to improvement in available properties, encouraging homeowners to enter the market.

Meanwhile, the mass-market sectors show more modest increases, with new sellers up by 10% and sales agreed rising by 9% and 13% for first-time buyers and second-steppers, respectively.

Despite more challenging conditions than in 2019, the total number of sales agreed has matched levels from that year. This stability has been underpinned by significant wage growth, which has slightly outpaced the rise in property prices. The average five-year mortgage rate currently stands at 4.84%, significantly higher than the 2.45% rate in April 2019.

“The summer holidays are typically a time of distraction for some home-hunters, as they temporarily pause their search and head abroad or to the British seaside,” Bannister said. “In addition, the Euro 2024 football tournament and the Olympics this summer, likely followed by a General Election during the second half of the year, will add more buyer distractions than usual.”

There appears to be a tempting window of opportunity for those who are considering a move to act now before these distractions arrive. While affordability is still very tight, property and mortgage market conditions remain stable, buyer choice is good, and many sellers will recognise that it is the right time to negotiate on price to agree a deal. The boost in activity suggests that many home movers are already springing into action to make their move.

Home movers are taking action

Home movers are taking action