UK House Prices Remain Subdued for Third Consecutive Month

House prices in the UK have remained subdued for the third month in a row, according to a leading lender. The average house price hit £288,455 in June, down only 0.2% on the £288,931 recorded in May, as a shortage of properties kept prices high. House price growth on an annual basis remained unchanged at 1.6%.

UK house prices have remained subdued for the third month in a row.

UK house prices have remained subdued for the third month in a row.

Amanda Bryden, the Halifax’s head of mortgages, said house prices had posted a seventh consecutive month of year-on-year growth. “This continued stability in house prices – rising by just 0.4% so far this year – reflects a market that remains subdued, though overall activity has been recovering.”

Mortgage rates have been cut by several lenders, offering hope for the market.

The prospect of the Bank of England cutting interest rates in August or September has led to a flurry of mortgage reductions this week, offering some relief to buyers and borrowers and stoking hopes of an improved picture later this year. Barclays, Halifax, and Santander have all cut their fixed-rate mortgages, while Leeds Building Society announced that it would cut its residential mortgage rates by up to 0.15 percentage points.

Mark Harris, the chief executive of the mortgage broker SPF Private Clients, said: “With the big five lenders – Barclays, HSBC, Santander, Halifax, and NatWest – reducing their mortgage rates this week, lenders continue to jostle for business as they ramp up the summer sales.”

House prices vary significantly by region, with London being the most expensive.

House prices vary significantly by region, with London being the most expensive.

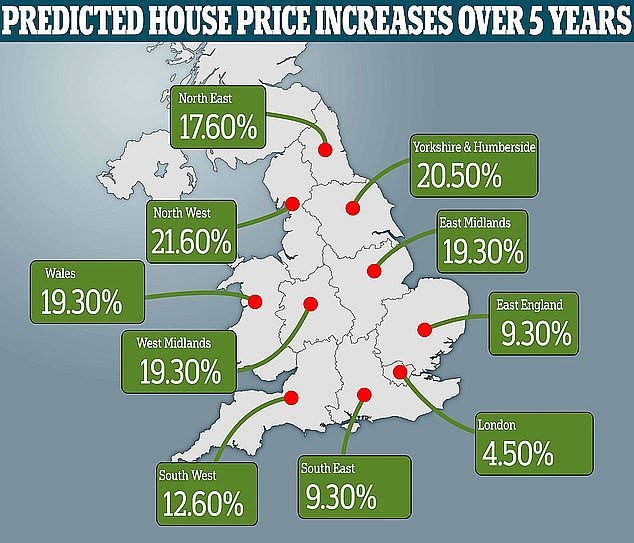

London continues to have the most expensive property in the country, with the average home in the capital costing £536,306, up 0.9% in June on a year earlier. The south-east of England was the second most expensive area, with the average house price at £385,056, while the north-east was the least expensive, with the average property costing £172,308.

The highest property price growth in the UK was in Northern Ireland, with properties costing £192,457 on average, a 4% increase on an annual basis.

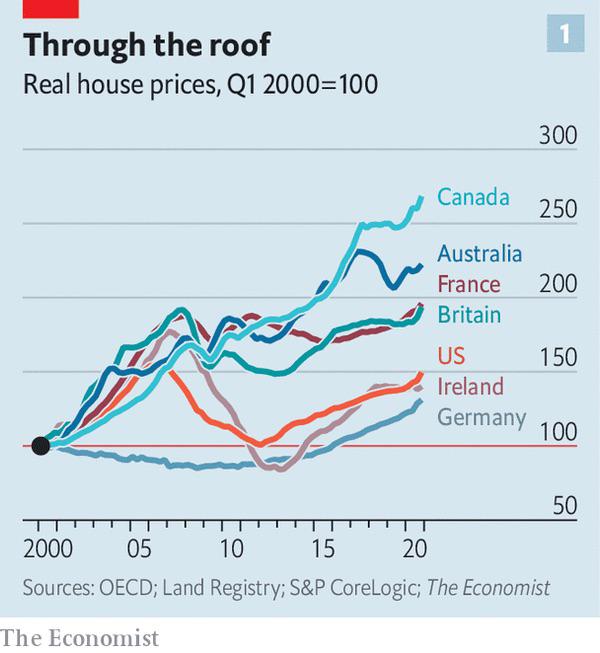

Bryden said: “While in the short-term the housing market is delicately balanced and sensitive to the pace of change to base rate, based on our current expectations property prices are likely to rise modestly through the rest of this year and into 2025.”

Estate agents are optimistic about the market, expecting prices to stay stable.

Estate agents are optimistic about the market, expecting prices to stay stable.

Jeremy Leaf, a north London estate agent and a former residential chair of the Royal Institution of Chartered Surveyors, said: “The election definitely added to nervousness in the property market but slower-than-expected falls in mortgage rates weighed more heavily.”

He added: “Looking forward, the rise in listings means prices will stay stable and the arrival of a new government will add certainty.”

House prices have remained stable in recent months, despite some fluctuations.

House prices have remained stable in recent months, despite some fluctuations.

Analysis by Rightmove published last month found that monthly mortgage costs for first-time buyers had increased by more than 60% since the 2019 general election. It said the average monthly mortgage payments for a typical first-time buyer was now £1,075 a month, up from £667 in 2019.

Bryden said that she expected mortgage costs to ease gradually through a combination of lower interest rates, rising incomes, and more restrained growth in house prices.