UK House Prices See Modest Rebound in May

According to the latest data from Nationwide, UK house prices increased by 0.4% in May, resulting in a slight pickup in the annual rate of house price growth to 1.3% in April, from 0.6% the previous month.

House prices see modest rebound in May

House prices see modest rebound in May

Commenting on the figures, Nationwide’s chief economist Robert Gardner said: “The market appears to be showing signs of resilience in the face of ongoing affordability pressures following the rise in longer-term interest rates in recent months. Consumer confidence has improved noticeably over the last few months, supported by solid wage gains and lower inflation.”

Fine & Country estate agent managing director Nicky Stevenson pointed out that house prices had been yo-yoing from economic gales, but May’s figures indicated calmer waters ahead for the housing market.

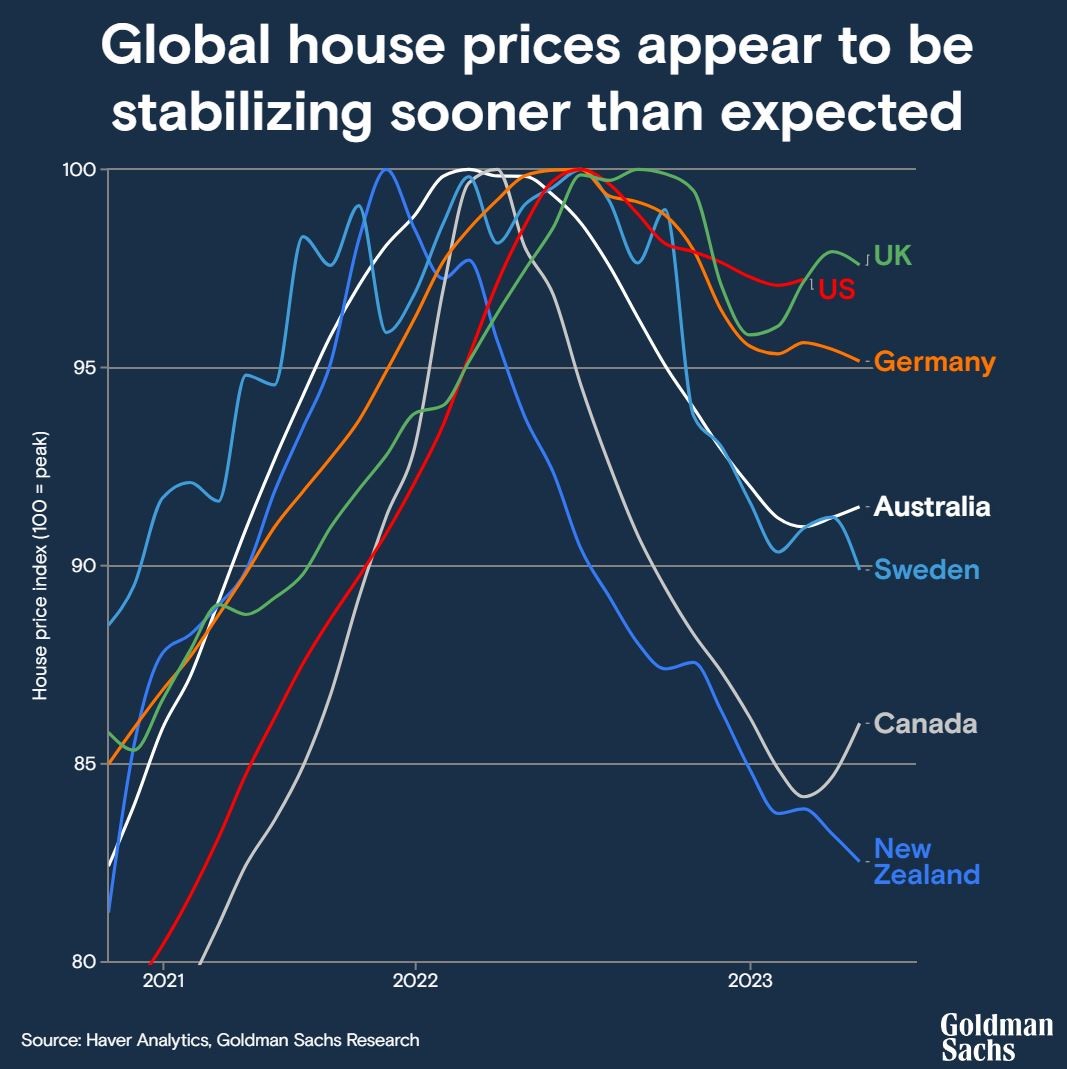

House prices stabilizing

House prices stabilizing

“Previously hesitant home buyers are feeling more confident to pull the trigger on moving plans as financial strains ease,” Stevenson said. “With inflation moving closer to the government’s 2% target and potential interest rate cuts this summer, demand may surge further into 2024. This will help to stabilize or even nudge prices upwards amid buyer competition – a positive development for sellers.”

Stevenson added that lenders were also lowering rates in response to more favorable conditions, making homeownership more attainable, especially for first-time buyers previously deterred by high monthly payments or excessively long mortgage terms.

Mortgage rates becoming more affordable

Foxtons chief executive Guy Gittins explained that not only has there been an uplift in buyer activity, but they’re also seeing more sellers return to the fold in order to take advantage of growing market momentum, with the number of offers being accepted at its highest since 2016.

Buyer activity on the rise

Buyer activity on the rise

Gittins added: “This positive start to the year has come despite interest rates remaining at 5.25%, and as market sentiment has improved, this has naturally led to a greater degree of positive property price growth.”

Together director Chris Baguley said that while today’s price rises will add to greater confidence in the market, first-time buyers and home movers will still be cautious, preferring to hold out until mortgage rates begin to fall.

Interest rates on the horizon

Interest rates on the horizon

“The Bank of England held the base rate at 5.25% for the sixth consecutive time, but there is optimism that a cut may come in the summer. This could spell great news for buyers as lower base rates will have a knock-on effect on the rate at which they can secure a mortgage,” Baguley said.