UK House Prices Stabilise Amid Rising Wages and Consumer Confidence

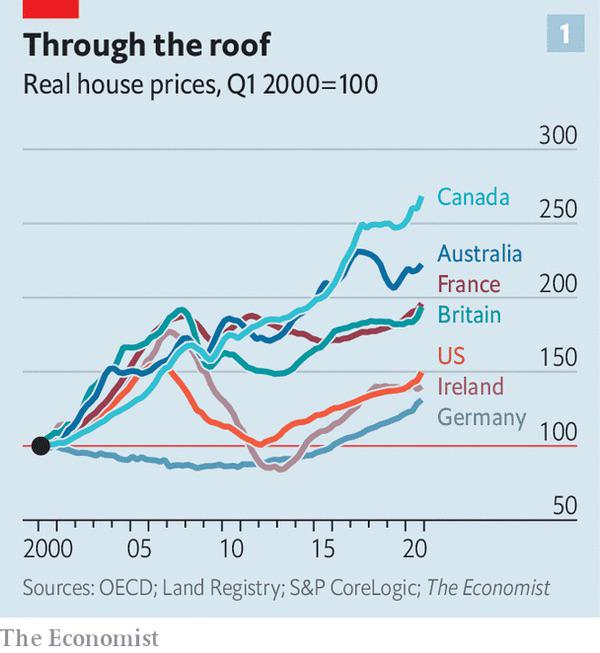

The UK housing market has shown signs of resilience, with average house prices stabilising in May. According to Halifax’s index, the typical UK home now costs £288,688, a slight decrease from £288,862 in April. On an annual basis, prices were up by 1.5% in May, up from 1.1% in April.

UK house prices stabilise amid rising wages and consumer confidence.

UK house prices stabilise amid rising wages and consumer confidence.

The north-west of England was the strongest performing area, with house prices growing by 3.8% on an annual basis in May. The average price of a property in the region stands at £232,258. Northern Ireland also continued to show strong growth, up by 3.2% in May.

The latest data adds to growing signs that the housing market remains robust despite the Bank of England’s decision not to cut interest rates so far this year. There was a rise in mortgage lending rates in the first quarter of the year that slowed the housing market.

“Market activity remained resilient throughout the spring months, supported by strong nominal wage growth and some evidence of an improvement in confidence about the economic outlook. This has been reflected in a broadly stable picture in terms of property price movements, with the average cost of a property little changed over the last three months.” - Amanda Bryden, Head of Mortgages at Halifax

House prices stabilise amid rising wages and consumer confidence.

House prices stabilise amid rising wages and consumer confidence.

Given the backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near term, according to Bryden.

In an upbeat trading statement, Bellway, the housebuilder, said its performance during the spring selling season remained “robust” with a rise in private reservations as it remained on track to deliver 7,500 homes for the year ended 31 July 2024.

Housebuilder Bellway reports robust performance.

Housebuilder Bellway reports robust performance.

Customer demand has benefited from an improvement in affordability, driven by a moderation of both mortgage interest rates and consumer price inflation and an increase in wages, according to Bellway.

The housebuilder also added that it had upped its expectations for its overall average selling price to £305,000 from previous guidance of £295,000 because of changes in its product mix.

Labour has said that, if it wins the general election, it will make permanent a mortgage guarantee scheme aimed at helping low-deposit mortgages become available for first-time buyers.

Mortgage guarantee scheme to help first-time buyers.

Mortgage guarantee scheme to help first-time buyers.