UK Housing Market: A Bubble Waiting to Burst?

The Bank of England has sounded the alarm on the UK’s housing market, warning of a potential bubble that could burst at any moment. With house prices rising by 10% over the past year, the central bank is urging banks to consider the risk of future interest rate spikes when approving mortgages.

UK house prices have risen by 10% over the past year

UK house prices have risen by 10% over the past year

The Financial Policy Committee (FPC), which monitors risks to the financial system, has expressed concerns about the sector, saying it will remain vigilant to emerging vulnerabilities. The FPC has also announced plans to introduce tougher home loan underwriting standards from next month.

Mortgage applications are set to become more stringent

Mortgage applications are set to become more stringent

The Bank of England has also warned that it will conduct stress tests on banks to assess their ability to withstand a sharp rise in interest rates and a fall in house prices. This move is seen as a precautionary measure to prevent a repeat of the 2008 financial crisis.

Banks will be stress-tested to assess their ability to withstand a crisis

Banks will be stress-tested to assess their ability to withstand a crisis

Analysts believe that the FPC’s tone suggests that more action will be taken on housing, including stricter mortgage stress tests for borrowers and lenders. The FPC has also hinted at scaling back the second phase of a government scheme to help homebuyers.

The government’s scheme to help homebuyers may be scaled back

The Bank of England’s warning comes as British banks face increased scrutiny over their financial health. The FPC has expressed concerns about the cost of past misconduct, including the rigging of the London Interbank Offered Rate (Libor) and the mis-selling of loan insurance.

Banks face increased scrutiny over their financial health

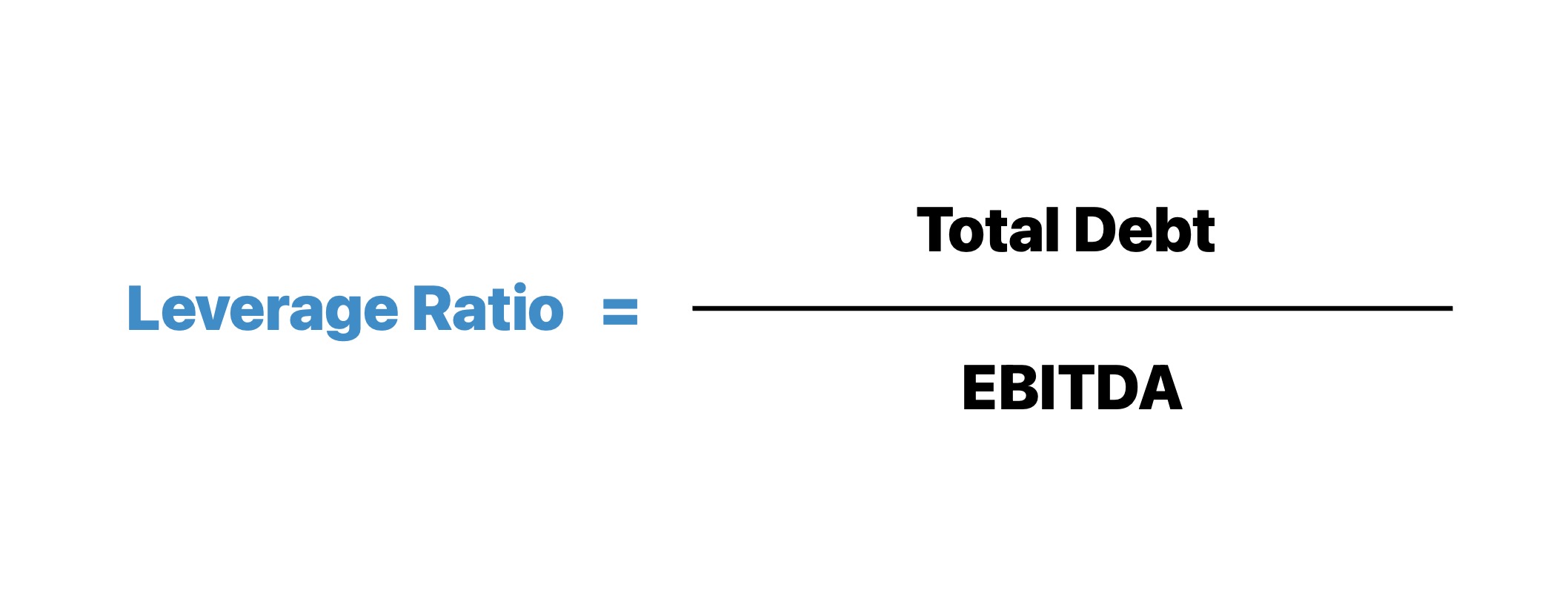

In addition, the FPC has announced plans to review the leverage ratio at banks, which could lead to higher capital requirements. The aim is to ensure that banks have sufficient capital to withstand any future crises.

The FPC will review the leverage ratio at banks

The FPC will review the leverage ratio at banks

The Bank of England’s warning on the UK’s housing market is a timely reminder of the need for vigilance in the face of rising house prices. As the FPC continues to monitor the sector, it remains to be seen what further action will be taken to prevent a bubble from forming.

The UK housing market remains a concern for the Bank of England

The UK housing market remains a concern for the Bank of England