UK Housing Market Recovery Faces Pressure from Revised Rate Expectations

The UK housing market recovery may be slowed down by revised rate expectations, according to a recent analysis by Bloomberg Intelligence. This comes as data from Moneyfacts shows the average two-year fixed rate edging closer to 6%.

UK housing market activity

UK housing market activity

Despite this, housing market activity seems to be improving, with the number of mortgage approvals for house purchase rising to their highest level in nearly two years, according to figures from the Bank of England. Average house price movements have also been subtle, with only small month-on-month changes.

“An easing in house price to earnings ratios could improve mortgage affordability and continue to support activity in the housing market.” - Bloomberg Intelligence

The firm expects low single-digit house price growth this year. The delay in expectations for the base rate cut may put pressure on the recovery of the UK housing market.

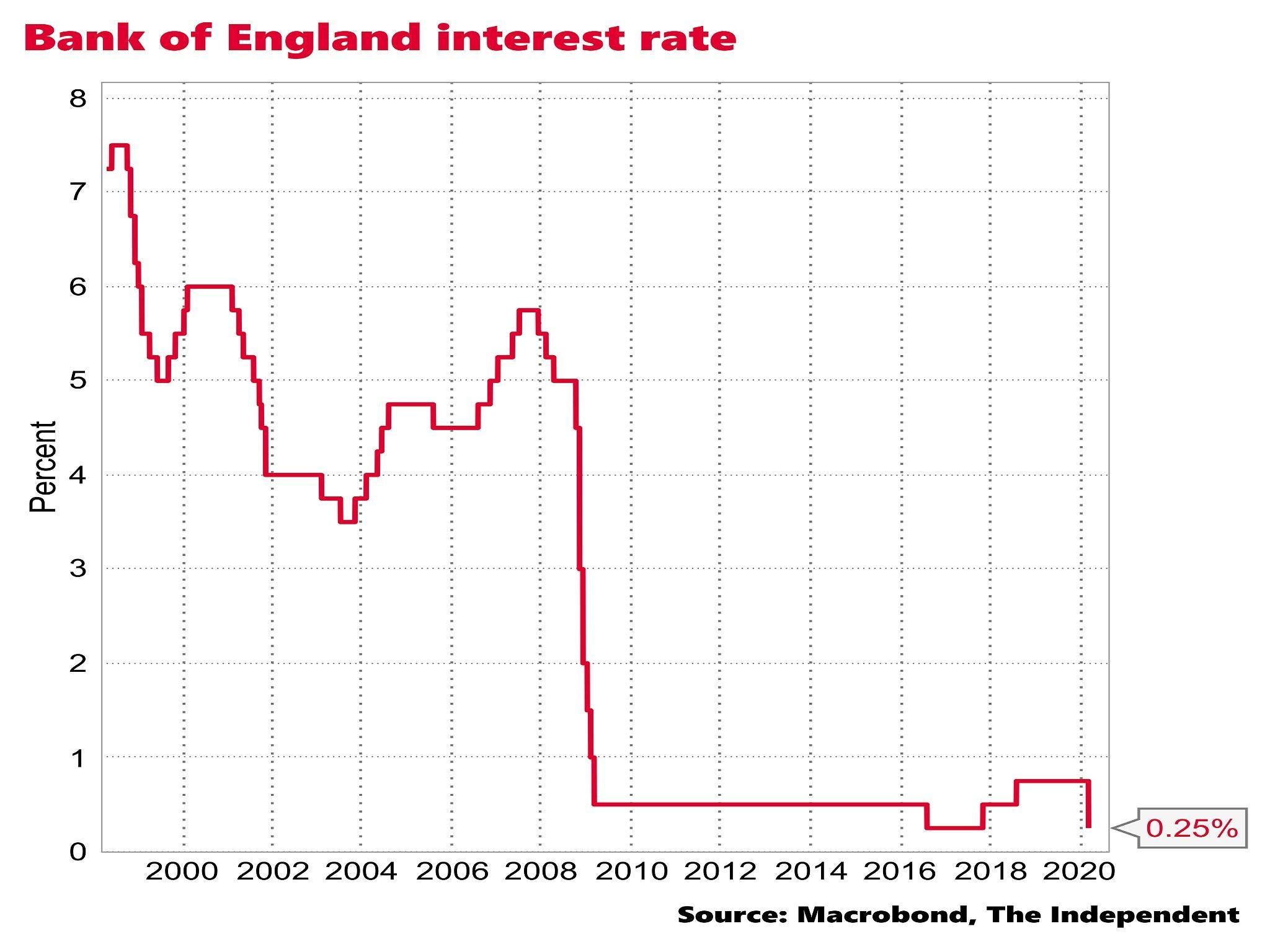

UK interest rates

UK interest rates

The UK housing market has been experiencing a subtle recovery, but the revised rate expectations may slow down this progress. As the average two-year fixed rate approaches 6%, it is essential to monitor the market closely to understand the implications of these changes.

UK housing market trends

UK housing market trends

In conclusion, the UK housing market recovery faces pressure from revised rate expectations. As the market continues to evolve, it is crucial to stay informed about the latest developments and their implications for the industry.