UK Housing Market Sees Decline in Demand as Buyers Await Interest Rate Cuts

The UK housing market is experiencing a decline in demand as potential buyers are putting their plans on hold, anticipating a decrease in interest rates later this year. According to a recent survey by the Royal Institution of Chartered Surveyors (RICS), the demand for homes has weakened in May, with the highest decline seen in the south east and south west of England.

Housing market uncertainty

Housing market uncertainty

Crest Nicholson, a UK housebuilder, has issued a profit warning due to the softening of sales momentum since Easter. The company attributes this decline to volatile mortgage rates and buyers’ expectations of a base rate reduction later in the year. This has resulted in a pre-tax loss of £30.9m for the six months to the end of April, compared to a profit of £28.4m over the same period last year.

Crest Nicholson’s profit warning

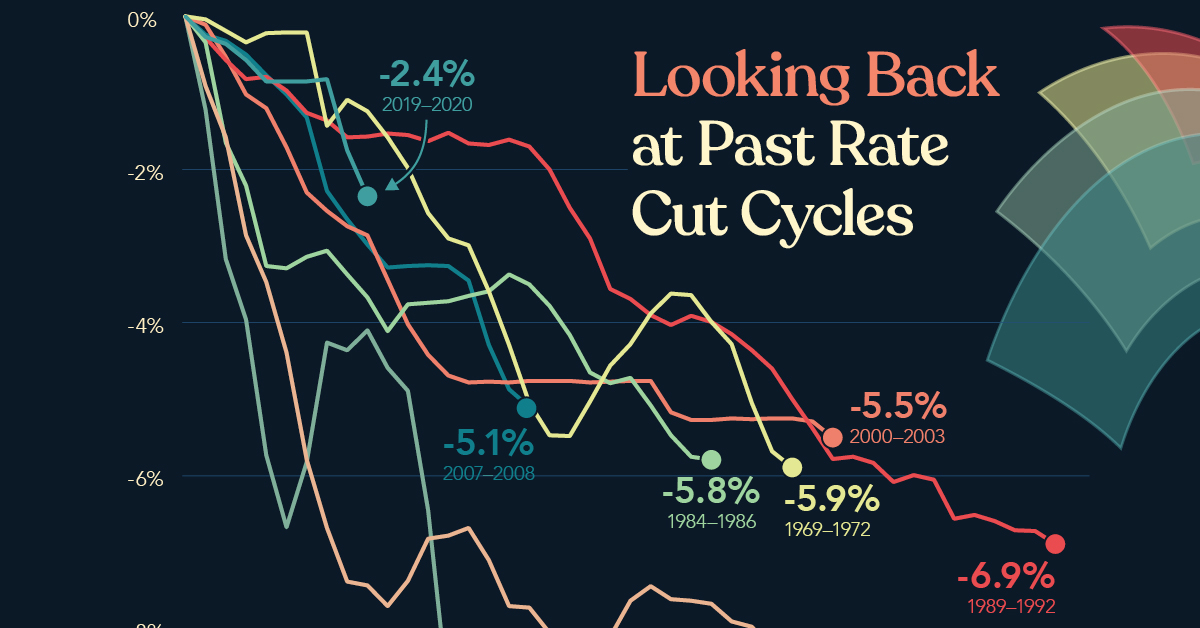

Financial markets are forecasting that the Bank of England could cut interest rates in August or September, which has led to a sense of uncertainty in the housing market. This uncertainty, combined with the imminent general election, is creating short-term uncertainty in the market.

Interest rate cuts on the horizon

Interest rate cuts on the horizon

Despite the current decline in demand, analysts predict that the housing market will see a modest improvement in the coming months, provided the Bank of England reduces interest rates as expected. Prices in Scotland and Northern Ireland remain robust, indicating that there are still opportunities for growth in the UK housing market.

UK housing market outlook

UK housing market outlook

In conclusion, the UK housing market is experiencing a decline in demand due to buyers awaiting interest rate cuts. While this has led to a profit warning from Crest Nicholson, analysts remain optimistic about the market’s prospects, provided interest rates are reduced as expected.