UK Housing Market Strains Grow as Mortgage Rates Creep Higher

The UK housing market is facing renewed strain as mortgage rates continue to rise. According to financial data provider Moneyfacts, the average rate on a two-year mortgage deal across the range of loan-to-value ratios has risen to 5.82%, up from 5.30% a month ago.

Image: A graph showing the rise in mortgage rates

Image: A graph showing the rise in mortgage rates

The increase in mortgage rates is a response to stubbornly high British inflation data, which has sparked a big jump in market interest rates. As a result, interest rates offered by mortgage lenders have soared. HSBC temporarily withdrew mortgage products for customers applying via brokers, citing the need to ensure new customers receive the best possible service.

Image: A screenshot of HSBC’s mortgage products page

Rival lender Nationwide Building Society has also raised its mortgage rates, having already revised them up twice since last month’s Bank of England interest rate hike. According to consultancy Oxford Economics, the repricing of mortgage products coincides with the peak period for existing fixed-rate deals ending, which will maintain the squeeze on household finances.

Image: A graph showing the predicted drop in house prices

Image: A graph showing the predicted drop in house prices

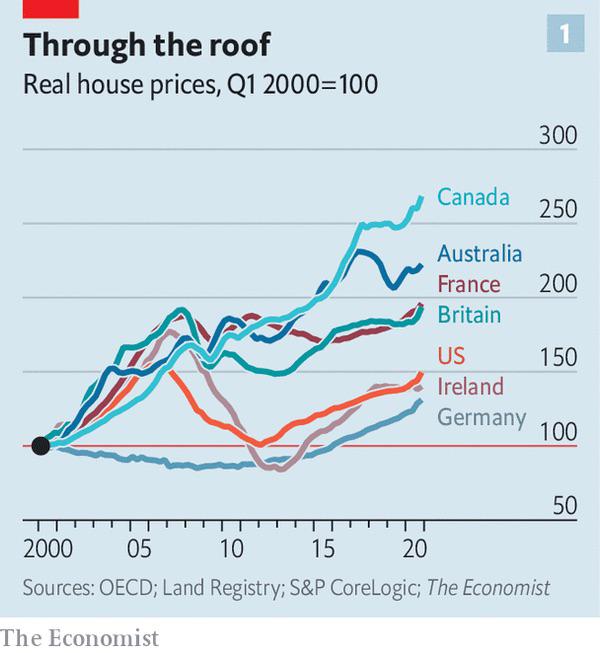

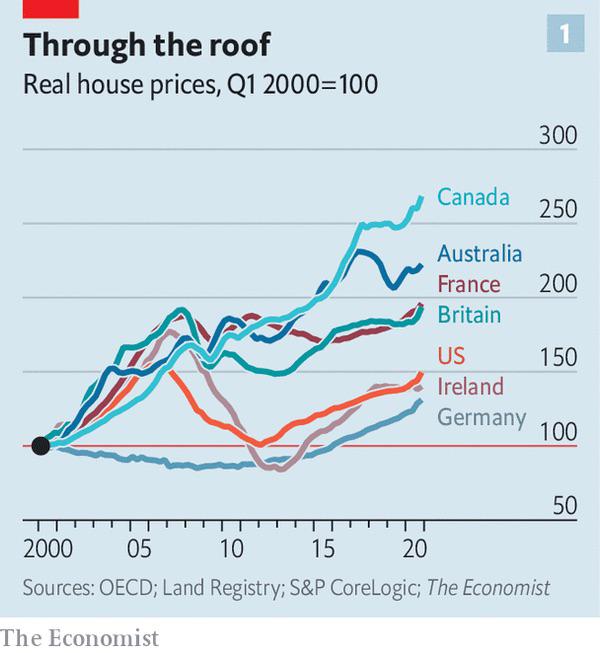

Oxford Economics predicts a 10% peak-to-trough drop in house prices, based on the Bank of England raising interest rates to 5%. Ratings agency Moody’s has also forecast a 10% drop in house prices.

Image: A graph showing the rise in mortgage rates

“This repricing of mortgage products coincides with the peak period for existing fixed-rate deals ending,” said Andrew Goodwin, chief economist at Oxford Economics. “This will maintain the squeeze on household finances, offsetting the boost from lower energy prices. It also suggests we’re likely to see an increase in financial stress and, potentially, a rise in the number of forced sales.”

Image: A graph showing the predicted drop in house prices

Image: A graph showing the predicted drop in house prices

The UK housing market is facing a challenging period, with rising mortgage rates and falling house prices. As the Bank of England continues to raise interest rates, it remains to be seen how the market will respond.

Image: A graph showing the rise in mortgage rates

Image: A graph showing the rise in mortgage rates