UK Inflation Falls to 2.3%: What Does it Mean for You?

As the latest Consumer Price Index reveals that UK inflation has dropped to 2.3%, the lowest level since July 2021, many are left wondering what this means for their wallets. In this article, we’ll delve into the world of inflation, explore why it’s fallen, and discuss what it means for the cost of living.

What is Inflation?

Inflation is the term used to describe the rising price of goods and services. The inflation rate refers to how quickly prices are going up. To put it into perspective, if an item cost £100 a year ago, the same thing would now cost £102.30 with an inflation rate of 2.3%. It’s a crucial indicator of the economy’s health, and the Government sets the Bank of England a target to keep the inflation rate at 2%.

Why Has Inflation Fallen?

Inflation has been steadily easing back over the past year-and-a-half, largely due to significantly lower gas and electricity costs. In fact, gas and electricity prices were about 27% lower in April compared to the previous year, according to the Office for National Statistics (ONS). Some food prices also fell last month, such as fish, milk, cheese, and eggs. Other food prices, like meat, vegetables, and bread, have just risen at a slower rate.

“Inflation is back to normal,” declared Prime Minister Rishi Sunak, calling it a “major milestone” for the country.

Does This Mean the Cost of Living is Falling?

Not exactly. While the cost of living is still rising, it’s doing so at a much slower rate than it has in recent years. About two years ago, prices were soaring by around a 10th, largely due to higher gas and electricity costs. The Government doesn’t want prices to fall, as it sets the Bank of England a target to keep the inflation rate at 2%. This ideal level helps people and businesses plan their spending.

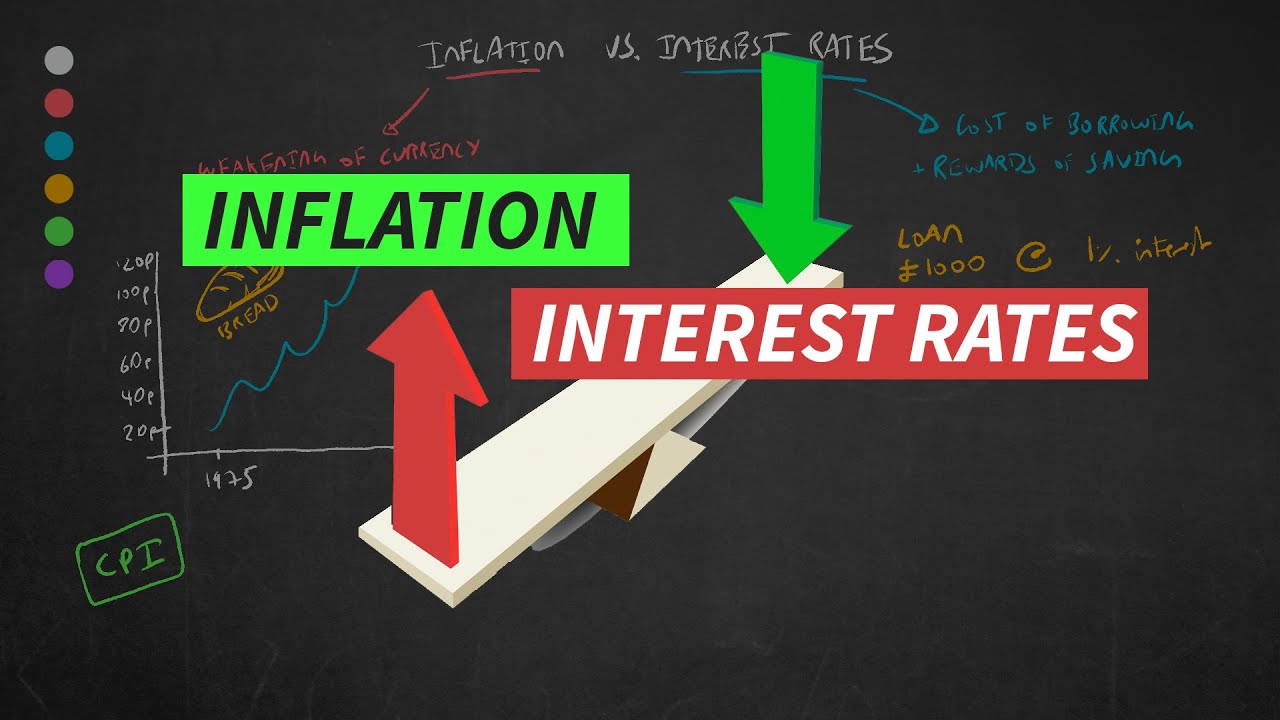

What Does the Fall in Inflation Mean for Interest Rates?

Interest rates are used by the Bank of England as a tool to help control inflation. Rates are currently at 5.25%, having been held at the level for the past six votes by the Bank’s policymakers. Economists had thought April’s inflation data could persuade the Bank to cut interest rates when the Monetary Policy Committee next meets in June, if it showed that prices were under control. However, services inflation, which looks only at service-related categories like hospitality, culture, and education, declined by significantly less than economists had predicted.

UK inflation rate over the past year

In conclusion, while the fall in inflation is a positive sign for the economy, it’s essential to remember that the cost of living is still rising, albeit at a slower rate. As the Bank of England continues to monitor inflation, it’s crucial for individuals to stay informed about the changing economic landscape and its impact on their wallets.

The complex relationship between inflation and interest rates

The complex relationship between inflation and interest rates