UK Mortgage Market: A Shift in the Winds?

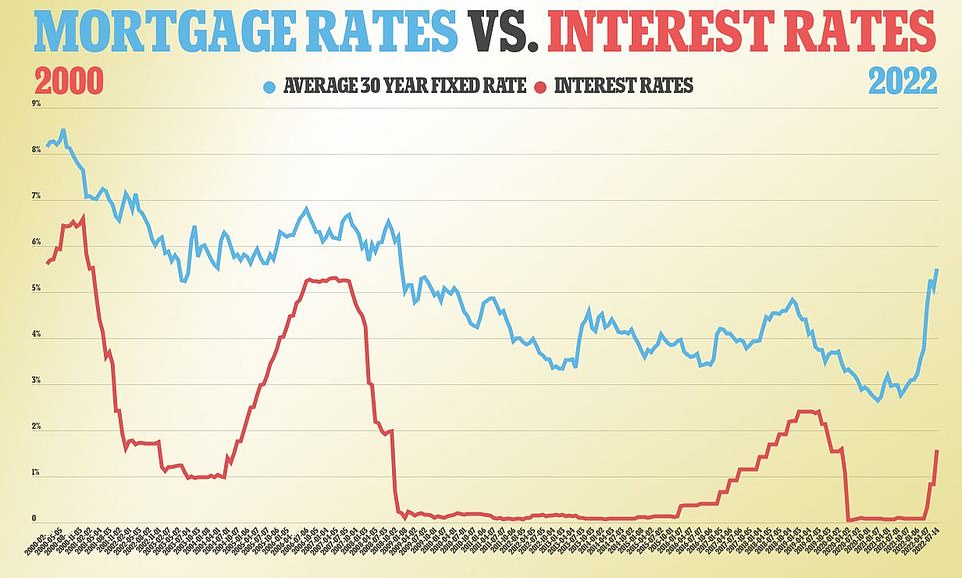

As we navigate the complexities of the UK mortgage market, it’s becoming increasingly clear that interest rates are expected to fall to 3.00% by the end of 2024. This shift in the winds could have significant implications for homeowners and potential buyers alike.

Mortgage rates are expected to fall, but what does this mean for the market?

Mortgage rates are expected to fall, but what does this mean for the market?

The Bank of Canada has expressed concerns that inflation could remain stuck above 2%, which could have a ripple effect on the mortgage market. Meanwhile, the mortgage stress test has helped protect Canada’s housing market in this downturn, according to OSFI.

The mortgage stress test has been a crucial safeguard for the Canadian housing market.

The mortgage stress test has been a crucial safeguard for the Canadian housing market.

Scotiabank has reported that variable-rate mortgage clients are showing signs of stress, while BMO has seen increased delinquencies. This perfect storm of factors has led to a sense of uncertainty in the market.

Mortgage delinquencies are on the rise, but what does this mean for the future of the market?

However, it’s not all doom and gloom. Immigration is providing an important buffer for the Canadian economy as the population ages, according to RBC. This could lead to increased demand for housing and a subsequent boost to the market.

Immigration is providing a much-needed boost to the Canadian economy.

Immigration is providing a much-needed boost to the Canadian economy.

As we look to the future, it’s clear that the UK mortgage market is in a state of flux. With interest rates expected to fall and mortgage delinquencies on the rise, it’s more important than ever to stay informed about the latest developments.

Stay ahead of the curve with the latest news and updates from the UK mortgage market.

Stay ahead of the curve with the latest news and updates from the UK mortgage market.

In conclusion, the UK mortgage market is facing a period of uncertainty, but with the right information and expertise, it’s possible to navigate these choppy waters. Stay tuned for more updates and insights from the world of UK mortgages.