Unlocking Affordable Homeownership in Kenya: The Role of KMRC

The landscape of homeownership in Kenya has changed dramatically in recent years, particularly with the recent policy shift by the Kenya Mortgage Refinance Company (KMRC). Previously, individuals needed to meet a strict monthly income threshold of KSh 150,000 to be considered for mortgage refinancing. However, in a significant move intended to gear up support for the government’s affordable housing agenda, KMRC has eliminated this income cap entirely, allowing all Kenyans with any level of income to access home loans. KMRC CEO Johnstone Oltetia elucidated this pivotal change, emphasizing the demand for increased housing solutions and the importance of making the homeownership dream achievable for more citizens.

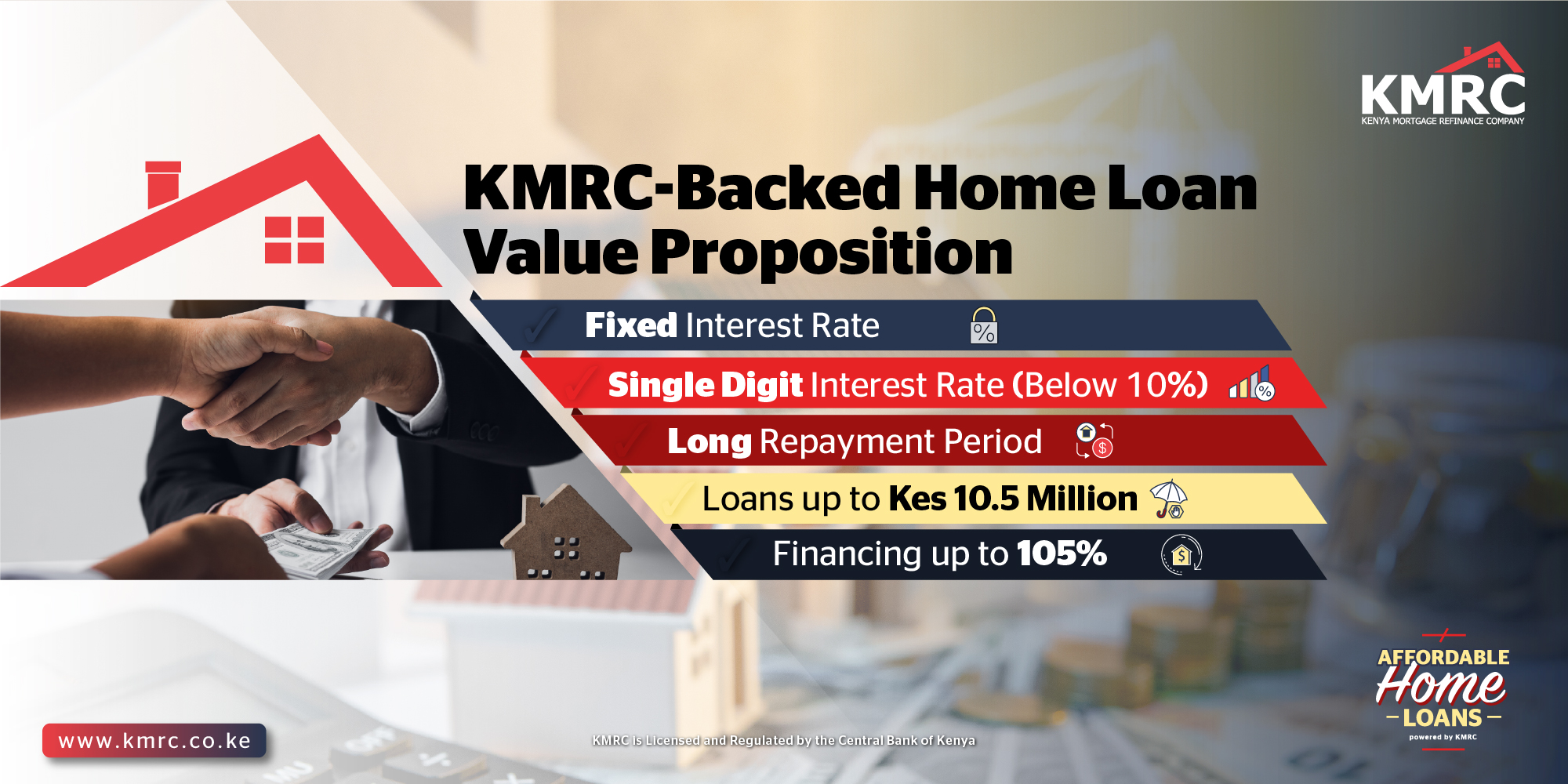

Affordable home loans in Kenya

Affordable home loans in Kenya

The New Threshold for Eligibility

With this recent update, questions abound regarding who exactly qualifies for these newly accessible home loans. KMRC has delineated a clear framework: all Kenyans, irrespective of their income level, can now approach primary mortgage lenders (PMLs) to secure financing for home purchases or land acquisitions. This seismic shift aims to bolster homeownership rates and aligns with the national strategy to address the alarming housing deficit currently facing the country.

Oltetia remarked, quote:

“We removed the income limit for all Kenyans to access a home loan, either to build a house or buy land. KMRC is a key player in increasing homeownership to augment the government’s commitment.”

Thus, this policy is not just about loans; it’s about empowering individuals and families across all socio-economic segments of society to invest in property.

Competitive Interest Rates: A Driving Force

When it comes to securing a mortgage, affordability is paramount. KMRC stands out in the market by offering long-term, fixed-rate home loans with an interest rate that’s consistently in single digits—below 10%. This is particularly advantageous for low-to-moderate income earners who have historically faced barriers when it comes to affording a home.

According to the KMRC, they have revolutionized the mortgage landscape by providing liquidity for mortgage lenders, thereby enabling them to offer competitive rates. Oltetia emphasizes this partnership’s importance:

“As long as you have an income, you can visit a primary mortgage lender and get a home loan.”

By ensuring that loans are available at sustainable rates, KMRC helps to mitigate the risks that often accompany homeownership, allowing more people to approach this major life investment with confidence.

A Safety Net Against Fraud

Another compelling aspect of KMRC’s offering is its commitment to ensuring that borrowers’ interests are protected throughout the loan process. Before refinancing a mortgage, the KMRC conducts thorough due diligence on the property in question.

Florah Muthaura, Head of Risk and Compliance at KMRC, noted:

“We ensure the primary mortgage lenders (MPLs) offering you loan conduct due diligence before we refinance.”

This process includes a comprehensive search to verify property titles, crucial for shielding homeowners from potential fraud. By securing these safeguards, KMRC not only builds trust among prospective borrowers but also instils confidence in the mortgage system itself.

A new housing project in Kenya under development

The Road to Homeownership: Steps to Acquire a KMRC Loan

Potential homeowners keen on entering the morgage market through KMRC can follow a straightforward pathway:

- Organise your finances: Understand how much you can afford by reviewing your income and expenditures.

- Reach out to financial providers: Discuss housing options that fit your budget.

- Plan your budget wisely: Aim for your monthly repayments not to exceed 40% of your net income.

- Check loan terms: Understand interest rates and repayment periods fully before committing.

- Identify property: Narrow down your housing options to know exactly what you wish to purchase or build.

This pathway ensures that even individuals who thought homeownership was unattainable can realistically assess their ability to enter the housing market.

Overcoming Challenges: Young Adults in the Property Market

While KMRC progresses towards democratizing homeownership, a recent survey among young adults reveals the nuances of this demographic’s perspective on property ownership. According to a study, 50% of surveyed 18-30-year-olds expressed doubts about their potential to purchase their first home due to perceived inaccessibility.

As many as 22% prioritized their career advancement over saving for a house, pointing to a cultural shift in priorities among the younger generations. Furthermore, only 49% are actively trying to save for a deposit, with a significant proportion indicating they don’t earn enough for a mortgage. This generational sentiment underscores the ongoing challenges the housing market faces, especially from the viewpoint of younger citizens struggling to navigate the complexities of today’s financial landscape.

Young adults facing challenges in the housing market

Young adults facing challenges in the housing market

A Glimpse into the Future of Housing in Kenya

Despite the evident challenges, the hope for a more accessible housing landscape persists. The Kenyan government aims to construct 250,000 housing units annually, a robust plan intended to alleviate the two million housing deficit. This strategy aligns with President William Ruto’s administration, focusing efforts on lowering mortgage costs and stimulating homeownership.

As KMRC continues to refine its offerings and policies, the landscape of homeownership in Kenya might finally transition from an elusive dream to tangible reality for many.

In conclusion, as systemic barriers to mortgage access gradually diminish, it becomes critical for both borrowers and lenders to foster a strong relationship that prioritizes trust, transparency, and long-term sustainability. With increased engagement in the housing market driven by organizations like KMRC and informed by evolving societal attitudes, the future for prospective homeowners appears brighter than ever.