Understanding the Impact of Budget Changes on Everyday Lives

As the UK’s fiscal landscape continues to evolve, millions of individuals are left wondering how the forthcoming Budget will affect their financial realities. Recent conversations with citizens reveal a broader narrative tied to rising costs, increased taxation, and shrinking disposable incomes. This article delves into personal stories that highlight the struggles faced by everyday people in light of these financial pressures.

Voices from the Ground

Hannah Clarke, a mother of two from Rutland, embodies the challenges many working families face today.

Hannah Clarke juggles work and study while managing family expenses.

Hannah Clarke juggles work and study while managing family expenses.

Having recently transitioned to full-time studies for a midwifery degree, Hannah reports a total monthly income of approximately £1,800, largely supported by a student loan. However, this sum barely covers her increased mortgage payments and essential bills. “I just about make ends meet, but it isn’t easy and I do sometimes have to ask for help,” Hannah shares. Her call for more inclusive free school meals eligibility reflects a desire for support that truly matches the living costs of families today.

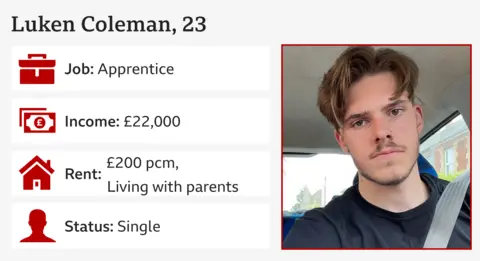

Luken Coleman, a 20-year-old apprentice working as a business administrator, lives in Newbury where rental costs hover between £700 and £900 a month. His salary of £1,500, while stable, leaves little room for savings or independence. “If I did move out, I’d have to move further away, so I’d need a car,” Luken states, illuminating the significant financial hurdles that young people face when trying to establish their footing in a challenging economy.

The Childcare Crisis

Relatedly, Yasmin Taylor from Kent faces a dire situation as a single mother of two, with childcare costs consuming £2,600 each month. Despite her hard work as a tech consultant, she feels penalized for her family responsibilities. “I studied and worked hard to get a job that pays a great salary, but I feel like I’m being punished for having children,” Yasmin admits. This financial burden showcases the pressing need for more affordable childcare solutions in the upcoming Budget, which could alleviate some of the pressure on working parents.

Challenges for Low-Income Workers

For many in low-income roles, the realities can be even more daunting. Kirsty Brett, a part-time cleaner in Bury St Edmunds, recently moved in with her sister due to the soaring costs of living. With a minimum wage of £11.44 an hour, Kirsty faces an uphill battle, particularly as her health condition, osteoporosis, limits her employment options. “I would like to see a rise in the National Living Wage,” Kirsty claims, pointing towards a necessary measure to better support those who keep our essential services running.

Minimum wage jobs are becoming increasingly unviable for many workers.

Minimum wage jobs are becoming increasingly unviable for many workers.

Stability Amidst Uncertainty

On the other spectrum of the economic ladder, we find individuals like Andrew Cunningham, a web developer living in Glasgow. As a middle-income earner with a focus on saving, Andrew’s primary concern lies with the potential impacts of budget alterations regarding tax-free saving initiatives. He states, “With the uncertainty around caps on tax-free ISAs, we may have to rethink our financial strategies to ensure a comfortable retirement.” This highlights an essential conversation about savings and investments that remains crucial for middle earners trying to secure their financial futures amid shifting policies.

Navigating Mortgage Payments

As families prepare for the financial commitments that come with parenthood, Ben Howard, from Bristol, is among a growing number feeling the squeeze of increased mortgage repayments. “Our mortgage went up by 60% recently, and while we’re comfortable now, government action on childcare costs is imperative,” Ben insists. His experience underscores the growing chasm between income growth and the rising costs associated with housing and family life.

High housing costs are impacting family budgets significantly.

High housing costs are impacting family budgets significantly.

Addressing Vulnerable Communities

For vulnerable populations, such as veterans and those reliant on government support, financial modifications can incite additional worries. Allana Lamb, a retired social worker, finds herself struggling just above the threshold for pension credit. “I am very concerned about the government stopping it. The state pension doesn’t cover the cost of living, even with the triple lock in place,” she expresses. Allana’s statements encapsulate the fears that many pensioners may experience as the Budget deliberates cuts and tax reforms.

Conclusion: The Urgency for Action

As the Budget approaches, the stories of families, individuals, and workers across the UK coalesce into a powerful narrative calling for urgent change. From advocating for better pay and support in childcare to highlighting the barrier of rising living costs, it’s clear that the voices of the people must be amplified in the decision-making process. The anticipated measures from the government must reflect the acute needs within society to foster financial stability for all.

In light of these discussions, it remains imperative to ensure that future policies are not only sustainable but genuinely responsive to the lived realities of those they serve. Following the Budget announcement, we must continue to engage with these crucial conversations and hold decision-makers accountable.

Photo by

Photo by