Weekly Mortgage Roundup: Market Movements and Financial Insights

As we delve into this week’s mortgage landscape, several stories have shaped the financial scene in the UK and beyond, from office return policies impacting employment to soaring housing costs. With evolving tariffs and interest rates, here’s a comprehensive look at the notable developments.

Wall Street Hits Record High

Markets have responded positively to the significant political shift in the US, with Wall Street reaching record heights in the aftermath of Donald Trump’s return to power. Economic analysts suggest that while the immediate effect is optimism, the longer-term implications on global markets, especially in tariffs and trade practices, remain uncertain. Read more about the market reactions here.

Market response following political developments.

Market response following political developments.

Asda Calls Workers Back to Office

In a bid to revitalize productivity amid market challenges, Asda has mandated a three-day return to the office for over 5,000 head office employees. This policy shift accompanies job cuts, signaling tough times ahead in the retail grocery market. Learn more about Asda’s announcement.

Tariff Predictions and Their Impacts

With Trump’s intention to impose substantial tariffs on Chinese imports, experts warn of inflation increases that could ripple into the UK housing market. Potential impacts on home borrowing rates could strain borrowers as inflation forecasts worsen. Explore Trump’s tariff implications.

“It’s hard to say what it’s going to mean for us now. There will be trade implications, but it’s not clear whether they will be flat tariffs that spark a trade war with China in which we all feel the pain or mildly protectionist measures.”

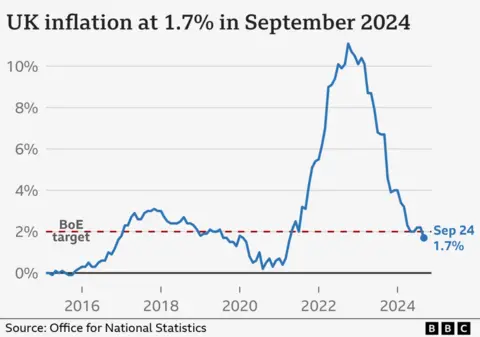

Inflation and Interest Rate Predictions

The Bank of England is expected to lower interest rates to 4.75% this Thursday, a move designed to relieve borrowing costs amid declining inflation figures. This reduction, however, poses challenges for savers, as returns on deposits are likely to drop. The impact of external market conditions remains critical as the UK observes how US federal policies evolve under Trump’s influence. Read more on rate cuts.

The outlook for interest rates as the Bank of England prepares to meet.

The outlook for interest rates as the Bank of England prepares to meet.

Rising Costs for Renters

Recent data reveals a 6.4% rise in spending on rent and mortgages, indicating heightened financial pressure amongst consumers. This increased financial burden could potentially lead to changes in rental market dynamics, particularly as home ownership remains elusive for many. A significant percentage of renters cite property prices as their primary barrier to ownership. See highlights from the Barclays report.

FCA’s New Guidelines for Mortgage Providers

The Financial Conduct Authority has issued new portfolio letters outlining priorities for licensing firms, emphasizing consumer protection, financial resilience, and prevention of fraud. These regulations are expected to shape the future landscape for lenders and borrowers alike, ensuring better service and compliance within the mortgage industry. Learn about the FCA’s priorities.

Conclusion

The mortgage market remains in a state of flux as economic conditions fluctuate and government policies evolve. As we navigate through these developments, consumers must stay informed to make better financial decisions. The trends observed this week signify important shifts in how mortgages and borrowing will look in the coming months. Stay tuned for more updates and insights in our next weekly roundup!