Weekly Roundup: Navigating London’s Property Market and Financial Trends

As the uncertainty in the UK housing and financial landscapes continues, various stakeholders are eagerly watching government developments, pivotal economic indicators, and industry shifts. Here’s a comprehensive summary of the key takeaways from recent news articles.

Insights into London’s housing challenges

Labour’s Budget 2024: A Beacon of Hope for Young Londoners?

Young people in London are pinning their hopes on the upcoming Budget, yearning for policies that could finally help them buy their first homes. A recent report highlights that a typical first-time buyer in the capital needs to save a staggering 30% deposit, equating to around £142,588. This figure is approximately 2.5 times what buyers elsewhere in the UK need, making homeownership in London particularly daunting.

Amidst a challenging economic climate, where average home prices remain astronomically high—85% above the national average—Labour’s ambitious housebuilding target of 80,000 homes annually is welcomed but raises concerns among experts. The current market dynamics raise questions about the feasibility of achieving these targets without robust demand in a previously stable market.

Cold Weather Payments Roll Out

In a timely move, the Department for Work and Pensions has announced that thousands of families across the UK will begin receiving £25 cold weather payments due to anticipated dips in temperatures. These payments are available for individuals qualifying under certain welfare benefits, providing much-needed financial relief as winter closes in. For more details, you can visit the Gov.uk website.

Financial support during freezing temperatures

Financial support during freezing temperatures

Mortgage Guarantees: Freedom to Buy Initiative

In an effort to support first-time buyers, the mortgage guarantee scheme, initially launched in 2021, is being rebranded as Freedom to Buy. This policy aims to aid buyers with a reduced deposit requirement, yet many experts argue that this initiative alone will not suffice to boost homeownership levels significantly. Increasingly, calls are being made for revitalizing the Help to Buy scheme, which has garnered widespread support previously.

Housing Affordability Crisis Combatted

With the unfolding housing affordability crisis, advocates argue for the revision of policies like the Lifetime ISA and Rent a Room schemes to enable more individuals to enter the market. Ongoing lobbying efforts aim for incremental reforms to help combat the steep deposit requirements and rising costs faced by aspiring homeowners in London.

“It’s vital that the Government adapts its support schemes to reflect the current housing market dynamics,” emphasizes Paula Higgins, CEO of the HomeOwners Alliance.

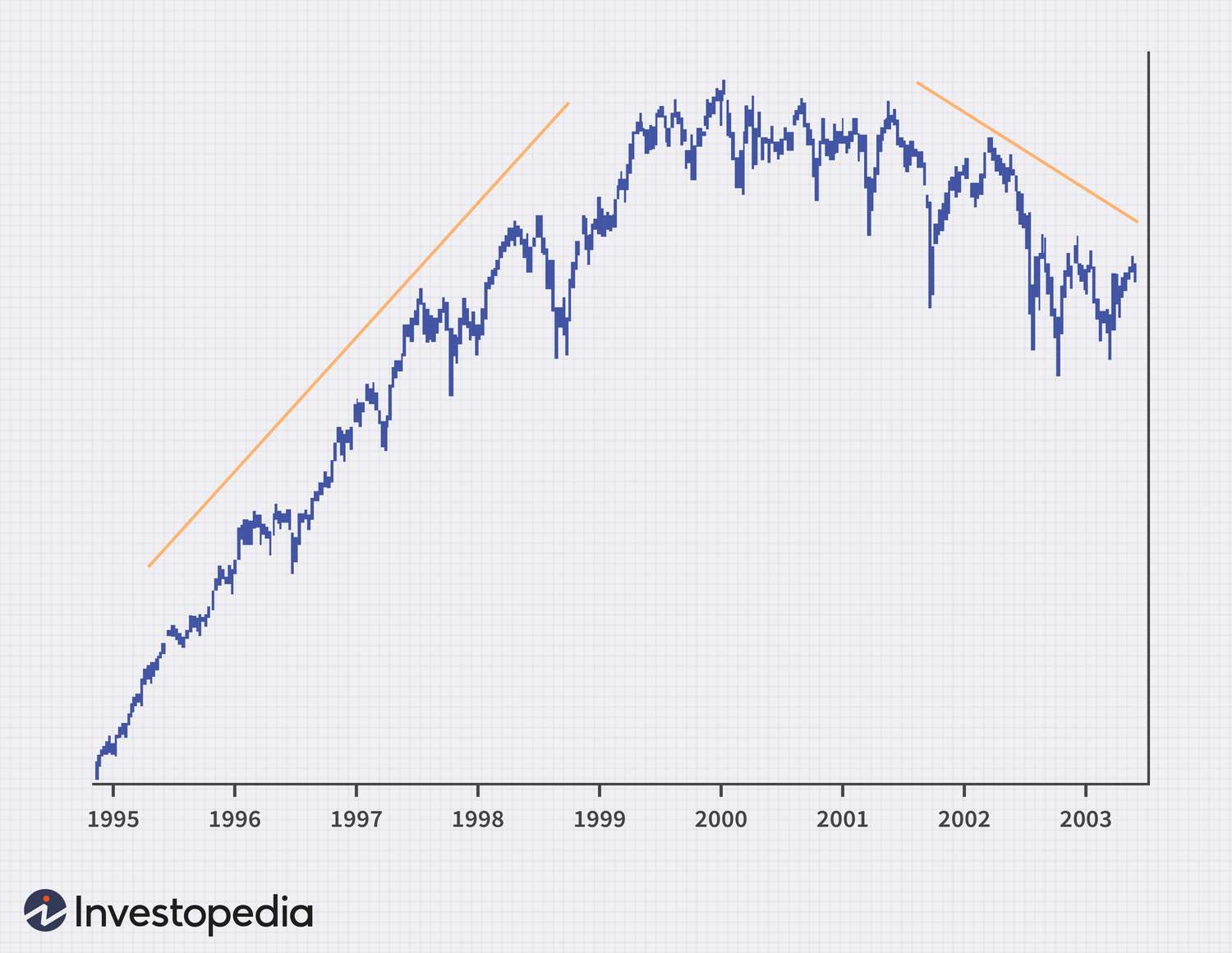

Financial Market Movements: Impact of Interest Rates

Meanwhile, financial markets are also showing signs of strain. The upward trend in bond yields, particularly the 10-year Treasury note yields which recently marked a 2-3/4 month high, is influencing stock markets negatively. Companies like McDonald’s and Starbucks are grappling with adverse press and weak earnings forecasts, leading to a decline in their stock prices.

This context may potentially cast a shadow over the financial viability of new lending and housing projects, causing lenders to exercise caution.

The effects of rising yields on stock performances

The effects of rising yields on stock performances

Conclusion: The Road Ahead for Homebuyers

As Londoners navigate this intricate web of housing policies and economic pressures, the future remains uncertain. Experts remain skeptical about significant reforms ahead of the October Budget that could genuinely assist the first-time buyers as rising home prices and interest rates keep many in a holding pattern. It is critical for policymakers to bridge the gap between housing availability and affordability to truly alleviate the pressures on potential homeowners.

While specifics on the Government’s approach post-Budget remain to be seen, the call for comprehensive reforms to housing policies continues to resonate throughout the community. As the season changes, so too must the strategies employed to ensure housing is accessible for all.

Anticipating new housing developments in London

Anticipating new housing developments in London