Owning vs Renting: The New Landscape of Home Ownership

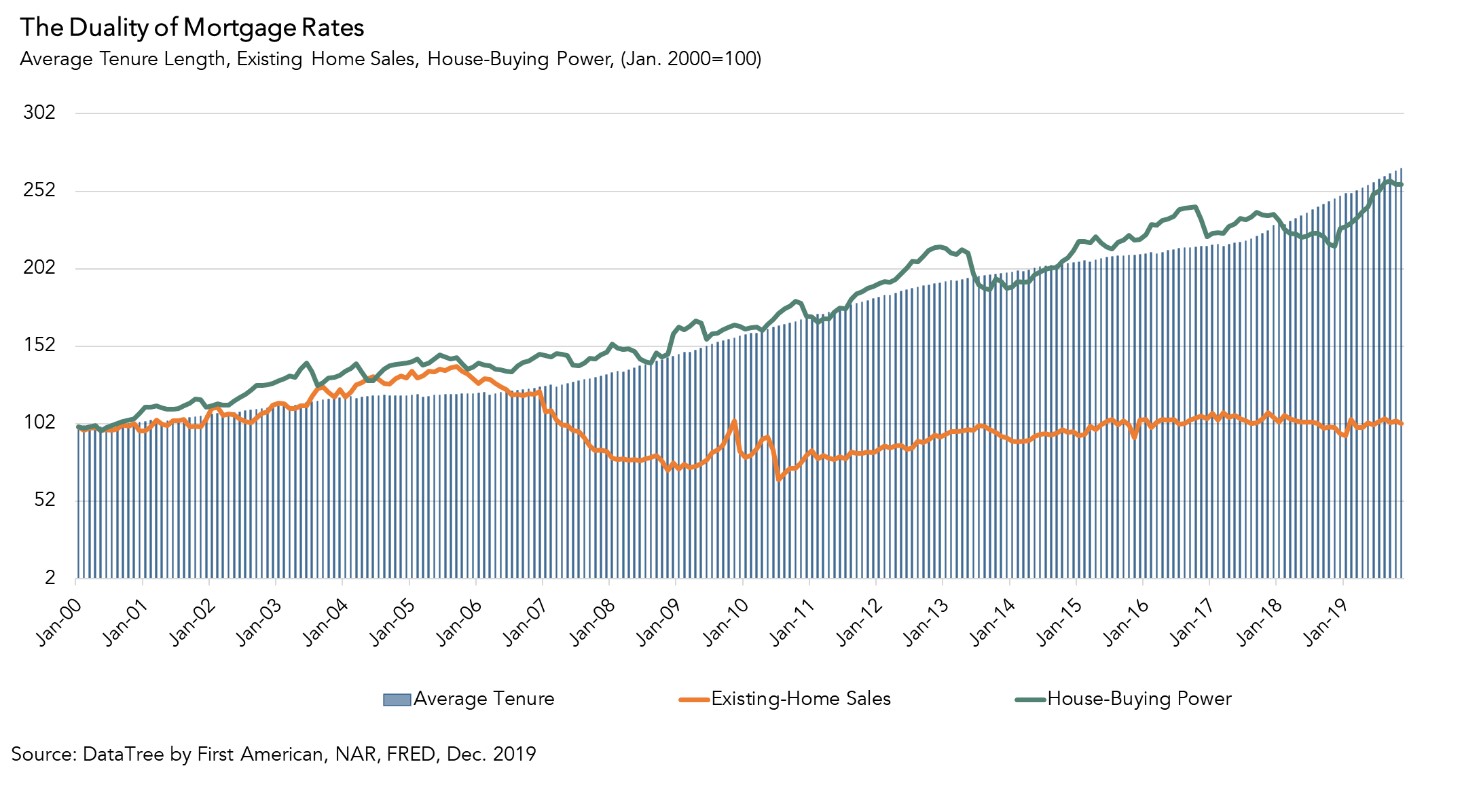

The landscape of home ownership in the UK is undergoing a transformative shift as first-time buyers find themselves with more advantageous opportunities than ever before. Recent trends have shown that, thanks to surprisingly low mortgage rates, the monthly cost of owning a home is now significantly cheaper than renting—marking a major shift from just a year prior when the balance tipped the other way.

Understanding the market shifts in mortgage rates and housing ownership.

Understanding the market shifts in mortgage rates and housing ownership.

According to the latest research by property experts, the average monthly mortgage payment for a typical first-time buyer’s property stands at 17% lower than the average rental cost. This shift is a breath of fresh air for those who have long anticipated purchasing their first home.

The Numbers Tell a Profound Story

Just last year, the balance was nearly level with mortgage repayments only 2% below rental costs. For context, a typical mortgage repayment on a 30-year term was £1,085 compared to £1,110 for rent. Today, however, with rent continuing to rise by about 5% , cost-conscious buyers are now only paying £972 per month on average as rental properties nudge £1,170.

The decision to purchase is no longer just a hopeful dream but rather an increasingly financially sound choice for many. Additionally, Zoopla reports that a substantial growth of first-time buyers is energizing the housing market, now accounting for a projected 36% of all sales in 2024.

The Challenge for First-Time Buyers

Nevertheless, the road to home ownership isn’t without its challenges. For first-time buyers, securing a substantial deposit can still pose a significant hurdle. The average asking price for a home that was previously rented is around £307,000, which is still considerably less than the UK average of £365,000.

Home ownership, it seems, is finally within reach for many individuals eager to leave renting behind. However, potential buyers must carefully consider their strategies and educate themselves on existing mortgage rates that hover around 4% to 4.5% as projected through 2025.

Exploring the dynamics of the property market and first-time buyers.

The Future of the Housing Market

Looking forward, the market is projected to experience modest growth, with prices expected to rise only about 2% in 2024. This growth, while modest, indicates a stabilized market compared to the year-over-year declines seen in previous months. This stabilisation offers a reprieve from the financial pressures many have had to navigate.

The increased competition could potentially lead to better mortgage options, as affordability remains on the minds of many affected by wage stagnation. As a potential homebuyer, it is crucial to act swiftly—coupled with understanding one’s target budget and familiarity with both fixed and variable rates on offer.

“Borrowers who need a mortgage because their current fixed-rate deal is ending, or they are buying a home, should explore their options as soon as possible.”

This insight is pivotal for those looking to make a shift from renting to owning. The rising numbers illustrate that while owning may soon become the less expensive option, timing and preparation play an essential role.

The Role of Mortgage Brokers

Engaging a mortgage broker can greatly ease the burden of navigating the myriad of available rates and could limit the time it takes to secure financing. Future buyers should be prepared to leverage their knowledge of the current state of the market and established relationships to make informed decisions.

Strategies for navigating the mortgage landscape.

Strategies for navigating the mortgage landscape.

In conclusion, if you’ve ever wondered whether now is the right time to purchase rather than rent, the answer seems to favour home ownership. The higher costs associated with renting are prompting many to reconsider their positions. With the right guidance and financial preparation, becoming a homeowner may very well transform from dream to reality for many aspiring buyers.

This time around, let’s hope that the momentum doesn’t just fizzle out as it has in the past. As first-time buyers step into their next chapters, let’s remain hopeful that the balance continues to tip in favour of ownership.

Take Action

For aspiring homebuyers, now is the moment to act. Don’t hesitate—explore your options today, review different mortgage deals, and consult brokers to better understand your financial landscape. The dream of homeownership is within reach; seize the day!

For more about the best mortgage rates, you can click here. To further understand your budget before making a move, take a look at this helpful resource.